In a Nutshell: Stocks suffer an epic pullback, while treasury yields fall to all-time lows. Nearly all investment securities fell in a coordinated manner, while only bonds provided protection.

Domestic Equity: The Wrong Side of History

U.S. stocks recorded their fastest ever fall from all-time highs to close out February. This move was as steep as it was unprecedented. Stocks had already priced in a global growth uptick as it became clear global economies were reducing their capacity in response to the recent virus outbreak. With S&P 500 companies producing essentially zero profit growth in 2019, while stock prices rallied over 25%, stocks were caught on the wrong footing. Zooming out a bit, we see below what a wild ride stocks have experienced over the last two years. During that time period, we’ve seen an annualized return of just under 5%, but also witnessed historically high spikes in volatility. Over this same time frame, when stocks have traded below the 200 day moving average like they are now (shown with the smoothed black line), downside risk was elevated. Investors will want to see that average defended along with the 3000 level (horizontal line). Additionally, moving forward, investors will want to see some clarity on the impacts of global demand and supply from numerous countries taking health-related action that may hurt their economies.

What a difference a month makes for the Federal Reserve Policy stance. The Fed just initiated an emergency rate cut of 0.5%, and the bond markets are pricing in another 0.5% cut at the next Fed meeting this month. These emergency rate cuts are not unprecedented, but also not encouraging. The last five emergency cuts occurred during our last two recessions. Hopefully this time is different, but the bond market doesn’t share that optimism. In fact, the bond market is currently pricing a 34% chance of rates at zero by the end of April. This is all happening with the backdrop of continued cash injections into banks via repo facilities. Though monetary policy has become an increasingly present item in our financial system, we’ve never seen this much intervention going on at the same time.

Global Equity: Here We Go Again

Emerging markets fell through support this past month as a large contingency of this sector was hit by the virus spread in Asia. Looking back over the past two years, emerging markets have been a frustrating position to hold, with no clear trend intact. Each time the sector has tried to break out of a prevailing downtrend, it has pulled back sharply. Now add in potential supply and demand shocks to this market, and this is one space worth steering clear of right now.

Real Estate: An Uncharacteristic Correlated Fall

In previous notes, we’ve talked extensively about how appealing real estate is in a low-yield environment. Additionally, it carries a relatively low correlation to stocks. That low correlation unfortunately morphed into coordinated selling in February. Real estate fell as fast as stocks and crushed any and all levels of support. This sector could still provide upside in the future, but for now we will wait and see.

Commodities: Gold Showing Resilience

We’ve seen a constructive trend with gold for a few years now and, in fact, gold has outperformed U.S. stocks by a factor of three over the last two years. However, even gold was not immune to the stock market shock from February, as you can see a significant correction below. That’s the bad news. The good news is that the uptrend in gold is still clearly intact. Additionally, the horizontal blue line below represents a huge level of support. If that support is held, there is a lot of upside for gold.

Fixed Income: Treasury Yields Hit All Time Lows

The yield on the ten-year U.S. treasury note has been cut in half over the past month. We highlighted the potential for the key support of 1.5% to break and break it did, making all-time lows in the process and, as of this writing, trading below 0.8%. We’ve never had rates this low in the U.S. before and, given the bond market’s reaction to the Fed’s recent response of rate cuts, rates could go much lower. This presents a major challenge to investors. With rates this close to zero, the return through yield is microscopic and the return through bond price appreciation (through lower yield) is now becoming extremely limited. Bonds will still provide protection to a falling stock market if that happens, but upside will be limited. If rates continue to approach zero, the true value of bonds will be their capital preservation qualities.

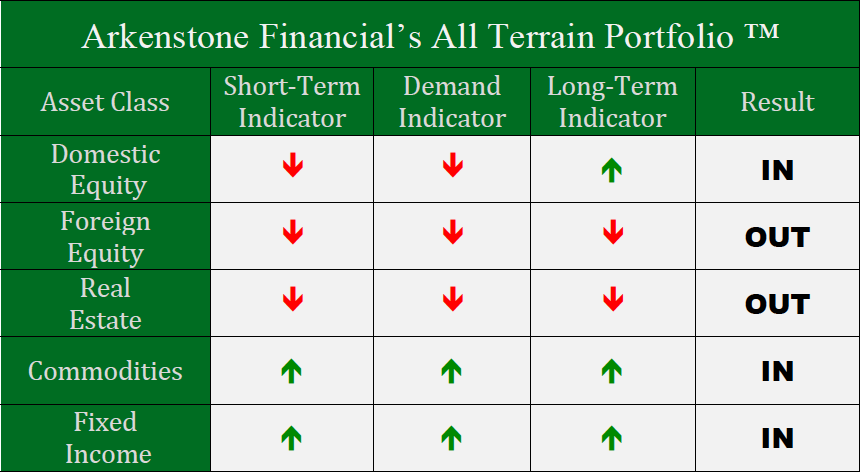

All Terrain Portfolio Update

The All Terrain Portfolio witnessed a litany of sell indicators this past month and we have reduced risk dramatically as a result. Though some relief from selling should come in the near future, with risk levels as elevated as they are, the All Terrain Portfolio will take refuge in a higher than normal allocation to cash. Risk management will continue to be the primary driver of this portfolio allocation.

Past performance is not indicative of future results. Other asset classes or investment vehicles may be used in client portfolios and client portfolios may not hold all positions of the model at the same time as the model. This chart and its representations are only for use in correlation to the proprietary timing model by Arkenstone Financial, Registered Investment Advisor. Actual client and All Terrain Portfolio(TM) positions may differ from this representation.

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply