There’s a good chance as a millennial you are accustomed to figuring things out on your own. You’re used to finding the answer to pretty much everything with a tap on your touch screen. However, #financial freedom can be a long road with multiple different paths to follow and, unfortunately, failures. Here a few tips to get you on the fast track to financial freedom.

1. Talk to Your Parents

The idea of asking your parents for financial advice might sound slightly painful (sorry Mom and Dad), but they are probably your most accessible resource. Even if they are not financial gurus, they’ll undoubtedly be able to share some of the facts of managing money they learned through experience and their advice could save you some money down the road. Don’t wait around for this parental advice, however, since your parents probably grew up thinking it was rude to talk about money. You’ll most likely have to solicit their advice.

2. Find Someone You Trust to Manage Your Money

A recent Fidelity survey found 1 in 4 millennials don’t trust their money with anyone. Although this may seem surprising it shouldn’t be, considering this generation became adults just in time to witness a general negative Wall Street perception, big bank bailouts and bad loan authorization. To combat this distrust, millennials should seek out independent financial advisors who are not commission-based and are willing to put their relationship with clients above the fees. Many younger financial professionals charge monthly flat fees and provide assistance beyond investing, such as budgeting and debt payment

3. Do Something About Your Student Loans

Student loans are a reality for millennials for which there is little precedent. College tuition has skyrocketed over the last 30 years and has created an environment where the average college graduate leaves school with about $30,000 in student loans. It’s an unfortunate reality, but one that needs to be dealt with. There are many ways to approach student loan debt, so pick one that works for you. Just don’t ignore it.

4. Earn It Before You Spend It

This is easier said than done. Because many millennials enter the workforce with student debt and maybe some credit card or car debt as well, it’s not hard to imagine how this could snowball into a lifetime of debt and monthly payments. However, the sooner you kick the monthly payment and debt habit, the sooner you’ll see financial growth instead of stagnation. Don’t buy things until you have the money to pay for them. This might make life uncomfortable temporarily after college, but it will be a start of a healthy financial habit for a lifetime.

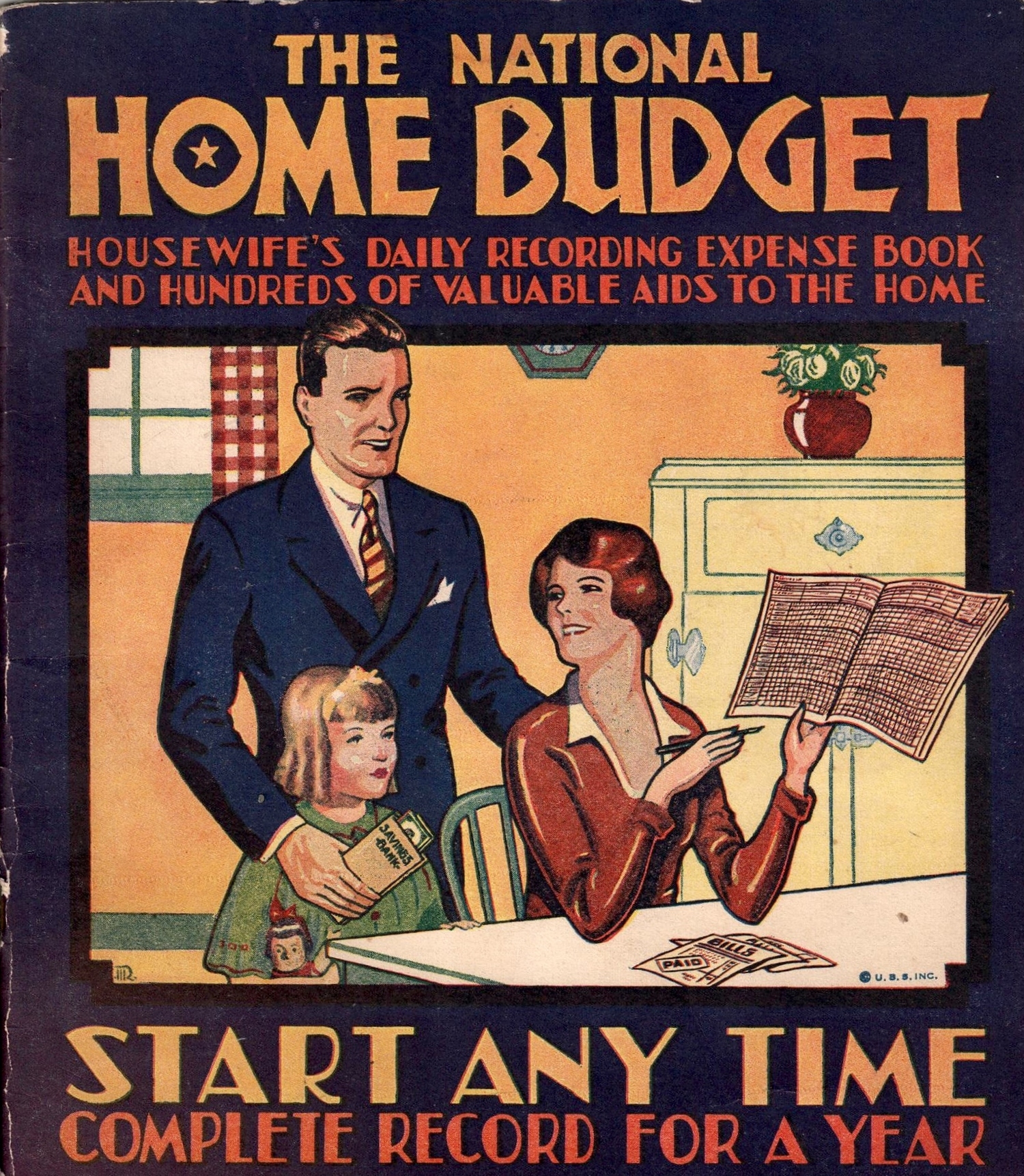

5. Know Where Your Money is Going

This is simple. Determine how much you need to spend on debt and how much you’d like to save or invest, then live on the rest of your income. In order to make your finances balance out at the end of each month you may need to monitor where the rest of your income goes by learning to create and maintain a budget.

6. Fill in the Financial Education Gaps

This is especially true if you are not going to seek out financial help from a professional. There are many free or inexpensive books and websites you can use to access good information on personal finance. Investopedia and the unofficial guide to banking are two free websites. A quick Google search of “best personal finance books” should give you a good starting place for books as well.

Interested in having us help your get on the path to financial freedom? Let us know at getstarted@arkfi.com.

Photo by Meng He

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

- Interest Rates Stabilize, Stocks Bounce - September 6, 2024

Leave a Reply