In a Nutshell: U.S stocks break out to new highs and are indicating we are on the verge of starting a new growth cycle. Meanwhile, bond market moves look more like end-cycle behavior. U.S. dollar relief exacerbates both moves.

Domestic Equity: Breakout or Fakeout?

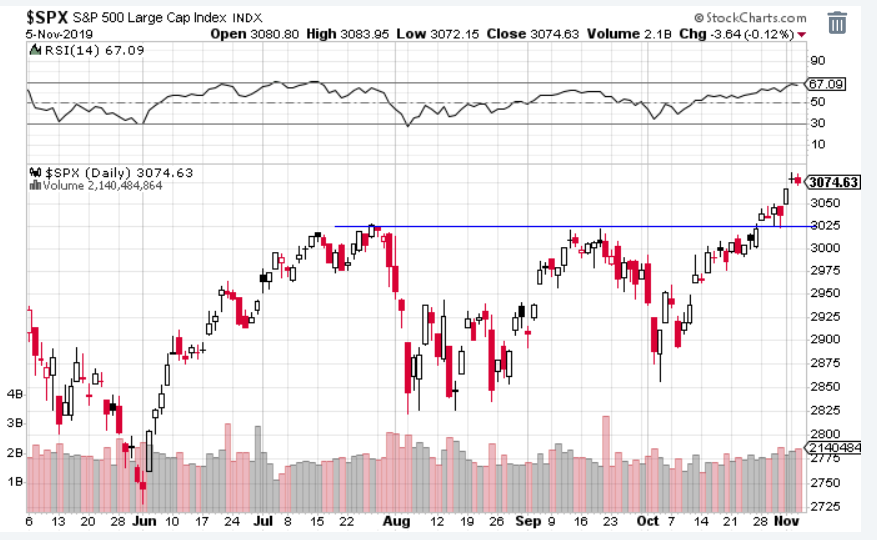

U.S. stocks made new highs in October as economic and business data ended up being not as bad as anticipated. You can see that breakout in the S&P 500 in the chart below.

Over the last two years we’ve seen breakouts in broader U.S. markets that failed to maintain momentum. Most of that has been driven by the fact that cyclical sectors like financials and industrials have failed to take part in the rallies. Below you’ll see that industrials have finally broken out of a large base:

Meanwhile defensive sectors, which have led the way over the last year or so, look like they are inclined to roll over.

This type of rotation from defensive to cyclical sectors would be very constructive for the broader economy and indicates that investors think we may be on the verge of another growth cycle. The challenge remains, however, that leading domestic economic data continues to deteriorate, making the growth case hard to justify. This divergence between expectations and price will be a key item to watch over the next few months.

The Federal Reserve cut rates again in October making for three straight rate cuts in as many months. However, markets are now pricing in stable interest rates for the next 12 months, meaning no hikes or cuts by the Fed in the foreseeable future. Although rates are looking to remain stable, the Fed has resumed the process of expanding its balance sheet. There is a lot of controversy surrounding the proper naming of this process, but the bottom line is that the Fed has resumed its practice of injecting the economy with liquidity (funding), which has generally coincided with stock price increases. Perhaps this is the reason investors are moving into more growth or cyclical investment positions.

Global Equity: Resolution to the Upside

Global stocks have been trending lower or flat for almost two years, but October saw a potential breakthrough. Although global markets are far from a new all-time high the flat short-term market movements from the last six months have finally given way to an upward breakout. There are still a lot of global economies that need resolution, but this could be the beginning of a longer term uptrend.

Real Estate: Falling Out of Favor?

Real Estate has been one of the strongest investment sectors in 2019. However, in October we saw what may be the beginning stages of relative weakness. Once real estate broke through its year-long consolidation in early 2019, we suggested that the sector was primed for a good run. Since then, real estate has maintained its blue trendline below. Recently, the uptrend saw a slight uptick (green line) and then broke that shorter-term trend. It’s not uncommon for an investment to “blow-off” or increase its growth trend before reversing. The blue trend line will be a very important marker to watch. If broken, this would confirm that investors are rotating out of defensive positions and into more aggressive, cyclical investments.

Commodities: The Dollar Backs Off, but Holds Support

The U.S. dollar pulled back slightly in October, and subsequently provided relief to stocks and commodities alike. You’ll see below that although the dollar fell last month, it still remains above support (horizontal line) and its uptrend line (diagonal). This is despite the Fed cutting interest rates and printing dollars simultaneously. This trend remains strong and will continue to put pressure on the global economy.

Speaking of relief for commodities, the chart below highlights what could be a breakout for the sector. A breakout in commodities will likely need continued relief from the dollar and should lead to a pick up in emerging market equities.

Fixed Income: Is the Bond Rally Over?

Bonds are in no man’s land right now. Below, you’ll see that intermediate tenor treasury bonds are on the verge of rolling over and on the wrong side of a very steep trendline.

Meanwhile, over the last few months, the ten-year treasury bond yield has been putting a series of higher low values, which generally coincide with an uptrend. Falling prices and rising yields go hand in hand, but our current historical, policy, and cyclical backdrop puts bonds in a peculiar position. Here’s a quick refresher on our current context: The yield curve inverted earlier this year — an event which has preceded the last three recessions. The yield curve has now uninverted, meaning short term rates are now lower than long term rates, with the help of Fed rate cuts. Now we have longer-term rates increasing with shorter-term rates stabilizing, indicating the steepening of the yield curve. The process of the yield curve inverting, uninverting, and then steepening is the typical cycle we observe prior to market tops and recessions. Will this time be different? Has the Fed successfully averted recession with policy moves? These are the questions we’ll continue to monitor and answer as time goes by.

All Terrain Portfolio Update

We’ve added some equity positions to the All Terrain Portfolio this month in small amounts. As our indicators dictate, we will add or subtract to these positions in the coming months. We will continue to monitor our indicators for more clarity.

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply