Domestic stocks broke through previous high marks set earlier this year. Stocks outside of the U.S continue to lag as a strong dollar puts pressure abroad.

Domestic Equity

U.S. stocks collected another positive month in August, logging over 3% in growth. Led by the healthcare and technology sectors, major domestic stock market indices broke through the highs previously set this past January. Although stocks took nearly seven months to make new highs, this long, steady consolidation is to be expected following the extraordinary run in 2017. U.S. stocks could face some short term volatility in the next month or two, but the majority of indicators point to a healthy finish for the year.

The Federal Reserve is expected to raise interest rates at their next meeting on September 26th. Currently, markets have priced in a 99% probability of rates increasing this month and a 67% chance we see an additional rate hike in December this year.

Global Equity

Markets outside the U.S. continue to face headwinds. Developed and emerging markets fell in August by roughly 3%. The continued sanctions and rhetoric regarding international trade from Washington has put a damper on global growth. Emerging markets looked to be finding the bottom this month and possibly reversing their downward trend; however, the downward trend has held and emerging markets are now down nearly 20% since their January highs. We will need to see either some trade resolution or a weakening in the U.S. dollar before global equities turn around.

Real Estate

Real estate continued its growth path for 2018 in August. We mentioned last month that real estate was approaching some price resistance in the short-term that could dictate the long-term result. For now, real estate has broken through the price resistance and is holding. If the sector can hold on, the outlook for real estate is very positive.

Commodities

Commodities were flat for the month of August, but selling pressure with commodities continues to have pros and cons. The good news is that following a recent low in price momentum, commodities put in a low price. While that might seem like a bad thing, this type of behavior can often preclude a reversal. This would be welcome news to a sector that has lost 10% since its May peak. However, the U.S. dollar is showing no signs of weakening. A strong U.S. dollar remains the primary obstacle to a commodities break out.

Fixed Income

Bonds were slightly up for the month of August with treasury bonds outpacing corporate bonds. Those gains might be hard to hold, particularly with another interest rate hike set for this month. Bond values and their yields move inversely, so a raise in rates could push values down. Inflation-protected treasury bonds have started to perk up as of late with the Federal Reserve acknowledging that inflation has experienced a slight uptick in 2018.

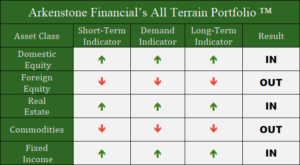

All Terrain Portfolio Update

The All Terrain Portfolio carries its cautious investment approach into September. Although we have seen positive action in U.S. markets as of late, we will continue to closely monitor all sectors with our various indicators, key support, and technical levels.

Past performance is not indicative of future results. Other asset classes or investment vehicles may be used in client portfolios and client portfolios may not hold all positions of the model at the same time as the model. This chart and its representations are only for use in correlation to the proprietary timing model by Arkenstone Financial, Registered Investment Advisor. Actual client and All Terrain Portfolio(TM) positions may differ from this representation.

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply