Global and domestic stocks rallied to close out March and finish the first quarter of 2016 slightly up after a poor start to the year. March also saw oil slip and bonds hold steady as the Federal Reserve continued its inconsistent action.

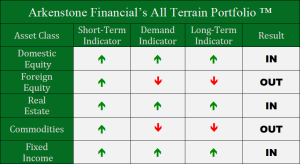

Domestic Equity

U.S. equities got off to a very poor start in 2016, but by the close of the first quarter all of those losses were recouped. The S&P 500, a popular U.S. stock market index, finished March right about where it started 2016. Despite this seemingly positive development, the Federal Reserve chair, Janet Yellen, stated that Fed will not be raising interest rates in March. In fact, not only did the Fed not raise rates, Yellen stated that the FMOC has put their target number of rate hikes at two for the year. This would be a reduction from four hikes promised just three months ago. To add to the confusion, the metrics that the Fed has sited in their decision making process, unemployment and inflation, are at or near their targets. Currently the market has given a 0% chance of an April rate hike, and with no May Fed meeting, June would be the next opportunity. Even a June hike, by most accounts seem unlikely. Most forecast a September hike, which would make two hikes in 2016 even more difficult to execute.

Perhaps what has the Fed uneasy is what so-called smart money is demonstrating. Smart money is the term coined for private, institutional and hedge fund money flows. A recent chart from Bank of America indicates that smart money has been selling U.S. equities for the last 10 weeks. It might seem conflicting that March could realize such a strong rebound amid all this selling, however, stock buybacks (companies buying their own stock) have accounted for the only categorical positive net flow into U.S stocks for the year. In fact, historically, January, February and March are the three largest months for buybacks based on volume. April, by contrast is the third lowest.

Foreign Equity

China managed to stay out of the news in March but that didn’t stop the European Central Bank from making a blockbuster announcement. The ECB announced they would cut its main interest rates to zero and move its bank deposit rate even further negative to -0.4%. The latter change effectively charges individuals to leave their money a bank savings account. Further, the ECB stated its quantitative easing program (central bank buying debt securities from banks to infuse cash into banking system and ultimately the economy) would be increased from €60 billion to €80 billion per month. The increase came as a surprise, but perhaps more shocking was the manner in which the ECB would execute the increase. Since the ECB perceives a liquidity issue with government bonds, it was forced to purchase private corporate debt in order to follow through on their quantitative easing policy. The ECB president continued flexing his monetary muscles by stating that the ECB is not out of ammunition when it came to monetary policy and will continue to do what is necessary to revitalize the European economy. This news provided a modest boost to global stocks, but the effect is far from clear considering how tightly correlated global stock movements are to U.S. stock movements.

Real Estate

This investment sector climbed again in March and its gains were capped off by the non-hike on interest rates by the Federal Reserve. There is a chance that with this sector’s typically high dividend payout and low current interest rates, real estate investing is carving out a niche as a safe haven for investors concerned with stock uncertainty. However, as we’ve stated before, real estate seems to have hitched its wagon to the U.S. stock market. If recent history is an indicator, the cyclical nature of this asset’s price movements suggest a cool down in performance.

Commodities

We made a big fuss last month about the OPEC announcement that would cut oil production in OPEC nations in an attempt to stabilize markets. It turns out that the announcement, although powerful, was never realized. Although this announcement was a primary driver in both oil and equities market rallies, more information revealed that Iran and Saudi Arabia have not agreed to anything. These two countries have been at extreme odds recently so this OPEC deal may not happen and oil fell to close out March. Gold, another big performer since the beginning of the year, has shown signs of letting up this past month too. If equities falter, gold should have another run, but until that happens commodities remain undesirable.

Fixed Income

Bonds continue to be a safe haven for investors despite limited upside and dividend yields. Our indicators have picked up on this movement as both government and corporate bonds have moved higher in March. As we mentioned above, with no perceived imminent interest rate hike and global equity concerns, investors are flocking into “safer” investments, like bonds. We’ll proceed with caution since this could all change after the Federal Reserve meets this coming month.

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply