In a Nutshell: Stocks, bonds, and now commodities sell off as sticky high inflation and a slowing global economy leaves nowhere to hide for investors.

Domestic Equity: Another Failed Rally

The S&P 500 traded almost 25% down on the year before managing a weak rally to close the month. Our 4200 level proved to be too much resistance for the index, as a 13% sell off ensued after failing to break through 4200. Our muted optimism about strong buying in May was quickly knocked out by even more impressive selling in the early parts of June, as evidenced by the circled data points below.

Looking back over the last 15 years, when such a low number of constituents of the S&P 500 are in an uptrend, these periods tend to be buying opportunities – as shown below by the green line. However, the lone exception was a brutally long and sustained bear market in 2008 to 2009. Although we have no interest in being alarmist, the reality is that we are in a period with high inflation and very unsupportive monetary and fiscal policy as a result. We just posted a -1.6% GDP in the first quarter of 2022, and are currently seeing a -2.1% estimate for second quarter GDP from the Federal Reserve’s own Atlanta branch. Additionally, corporate earnings will now be reporting (starting July 15) against historically high comparisons, so corporate profit growth will be hard to show. With all of that negative context, we have to be prepared for the possibility that this stock market drawdown could last quite a bit longer.

The Federal Reserve raised rates 0.75% in June, a full 0.25% more than expected. Markets are now expecting another 0.75% in July. The Fed continues to aggressively fight inflation while stating they think the economy is still in good shape. However, for the first time in 2022, market expectations for future rate hikes for this year are falling. It seems investors are waiting for the Fed to switch to a more accommodative stance if the economy continues to deteriorate.

Global Equity: Weakness Continues

Global stocks continued their downward slide last month. Most of the developed countries, especially in Europe, continue to battle with high inflation and deteriorating economic growth. The price action for global stocks hasn’t even approached the top end of its downward channel in a few months, so while a countertrend rally could be due, global stocks are broadly nowhere near being investable at this time.

We mentioned that China is one of the few options across the globe that looks promising. China is actually easing monetary policy while the entire globe is tightening. This easing has started to allow economic data to reverse course and begin rebounding. From the chart below, there is still one major hurdle that price must cross as evidenced by the blue trend line from 2021 to the present. If price breaks through, this could be a unique opportunity in a very limited investment landscape.

Real Estate: Falling and Trading Like Stocks

Another month, and another step down for real estate. Real estate was again denied by a prior low value, sending it further down. Perhaps one of the most telling characteristics of real estate right now is how correlated it is trading to risk assets, particularly stocks. The bottom portion of the chart below shows a near perfect positive correlation to stocks at about 95%. Real estate is traditionally one of the least correlated risk assets to stocks, but right now all risk assets are being sold off, regardless of perceived safety.

Commodities: Major Reversal

In an incredible change of direction, the broad basket of commodities sold off about 20% in the month of June. While oil is still trying to hold on to a positive trend, just about every other hard and soft commodity is now in a clear down trend. An interesting observation is that broadly, commodities are now trading at prices seen prior to the Russian incursion, which sent prices flying higher. So it’s possible that commodity prices are stabilizing, post invasion.

What to make of this move? Is inflation subsiding or is demand cratering? Here’s a look at copper, one of the bellwethers of economic growth. Copper is used in industrial production and construction and tends to lead economic growth. Copper is down around 30% since April and is now trading near pre-Covid highs from 2018. The good and the bad of this move is that this may be an early sign of inflation receding, but it could be coming at the expense of future growth.

Gold finally broke the support we were watching and will now have to do a significant amount of work to get back into a positive trend. We’ll sit on the sidelines and wait until an uptrend is resumed.

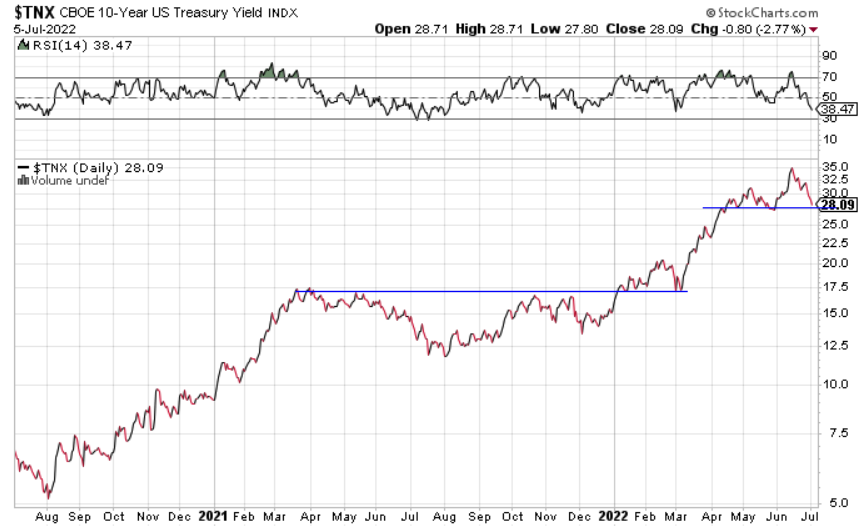

Fixed Income: Inflation or Recession?

The 10-year U.S. Treasury bond rate went flying higher in June, hitting 3.5% – the highest we’ve seen since 2011. That peak was right at the Fed’s June rate hike, but expectations fell for future 2022 rate hikes, and the 10-year UST retreated back to the key support level of 2.8%. Those are huge moves – nearly 25% in both directions – to occur in such a short period of time. We can’t help but wonder if the bond market has shifted focus from inflation to recession. If inflation is the concern, rates should go higher. If recession is the concern, rates should go lower. The recession concern seems very real as we could be facing back-to-back negative quarters of GDP (as mentioned in the domestic equity section above), which rarely occurs outside of a recession.

With interest rates “out of bounds” on a longer-term picture, and growth stalling, mean reversion of rates could bring us back significantly lower.

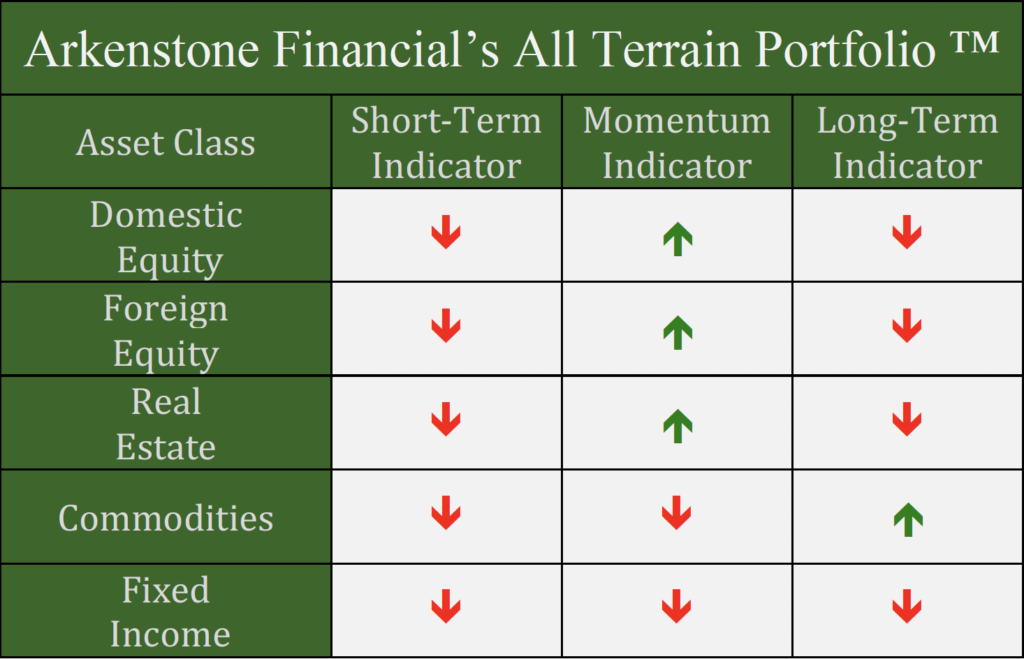

All Terrain Portfolio Update

Our signals and indicators continued to rotate out of risk assets, as we now carry over 93% cash in the All Terrain Portfolio. Despite our wide ranging potential investment exposures allowed by our model, there are very few investment options that fit our criteria currently. We will continue to wait for investment opportunities, and in the meantime, follow our indicators and process to adjust risk as new data is presented.

Past performance is not indicative of future results. Other asset classes or investment vehicles may be used in client portfolios and client portfolios may not hold all positions of the model at the same time as the model. This chart and its representations are only for use in correlation to the proprietary timing model by Arkenstone Financial, Registered Investment Advisor. Actual client and All Terrain Portfolio(TM) positions may differ from this representation.

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply