In a Nutshell: Stocks and bonds rally to close the month flat, while commodities break out to fresh new highs, leading inflation higher.

Domestic Equity: Despite the Rally, The Trend is Down

By mid-May the S&P 500 had briefly touched the -20% mark from its January 2022 peak, intraday. This -20% is often the arbitrary threshold to classify a market as a “bear market.” The market subsequently had a very strong rally of about 7% to close out the month, but was still down roughly 14% from the peak. From our view, regardless of arbitrary titles, the trend is down, as shown below. We posited that the 4000 level would trade last month and wanted to see how the market responded. 4000 did trade last month and though the market would go on to touch 3800, it has since rallied and taken back the 4000 level. Additionally, we saw a volume thrust (circled below) that illustrated buyers’ willingness to step in below 4000. For now, the big resistance at the 4200 level has proved to be the upside cap to our current rally.

Despite seeing the strong volume thrust on the S&P 500, when we zoom out even further and look at stocks more broadly, participation looks very normal for a bear market. Below, we see a time series of more and more stocks falling than rising – nearly perfectly in line with the stock index performance. We are expecting more murky-to-negative economic and inflationary data ahead, so we’ll need to see more strength from price action to get excited about U.S. stocks, broadly.

The Federal Reserve raised rates another 0.5% in May, with another 0.5% expected in mid-June. The Fed continues to focus on fighting inflation even at the expense of the economy, and has been explicit in this objective both by its words and actions. Although it is worth mentioning that for the first time since the Fed took the hawkish stance, it hinted at the possibility of backing off by the end of this summer.

Global Equity: Weakness Continues

Global stocks continued their downtrend despite the rally off of the mid-May lows. Foreign stocks, in general, remain unattractive based on past price action and forward-looking economic growth estimates. There are very few optimistic economic growth projections in the G20 group of countries.

The one exception in the G20 group is China. The economic outlook for the rest of 2022 actually looks pretty good as of right now. That also corresponds with the post-Covid performance of China. They were the first country to recover economically from Covid, and were the first country to falter post-Covid, as the chart shows below. China has been in a bear market since the beginning of 2021 and just broke through short-term bearish trend. With the country reopening business after a brief lockdown due to Covid concerns, and positive economic data ahead, breaking through the longer-term bear trend would make for an interesting opportunity.

Real Estate: Support Lost and Now Lagging

Last month we highlighted the broader reversal pattern we were witnessing in real estate. May gave us some important price information as not only was this key support level lost, the level flipped to resistance as price was rejected at the level that was once support. The additional context is potentially more important: Interest rates rose again, which is a huge headwind for real estate. Additionally, the stock market had a strong rally off of the May lows, whereas real estate’s bounce off of the lows was much weaker. This sector looks bad at just about every angle.

Commodities: Another Move Higher

The broadd basket of commodities just broke out to new highs after three months of consolidation. Oil was the primary driver of this move, but when you look under the hood of the commodities complex, other components that had been weakening took off as well. This is good news for those invested in commodities, but bad news for those looking for inflation to cool. Also bad news for future economic growth, as higher inflation leads to tougher monetary policy which leads to growth slowing at a faster rate. This breakout is fairly convincing as it comes with both a breakout in price and momentum. If commodities can hold this recent breakout, this should be a great place for investors to hide out, but it’s bad news for consumers and the economy in general.

Gold is narrowly holding on to its breakout and had another weak month in May. If the lower support level indicated by the horizontal blue line is not held, investors should look elsewhere.

Fixed Income: Rates Break Higher Again

Interest rates are in a historically precarious position, threatening to buck a 40-year trend of going lower. We mentioned last month how these moves have typically been head fakes that ultimately mean reverted lower, as we saw in 2008 and, more recently, in 2018. The key difference between now and those prior instances is that inflation is significantly higher in the current time. That makes our roadmap below a bit less trustworthy.

Zooming in closer we see that what was potentially a peak in rates (around 3.2% in the 10-year U.S. Treasury note) at the beginning of May was short-lived, as support in the 2.8% range has held and we’ve gone higher from there. This move seems to be aligned with the increasing commodities prices and expectations for higher inflation for longer. Interest rate moves from here will be very important as the bond market continues to grapple with pricing in inflation against economic growth deterioration.

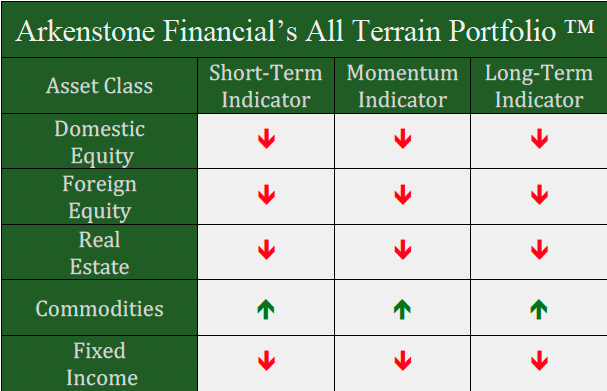

All Terrain Portfolio Update

Our indicators and models pushed the allocations in the All Terrain Portfolio even more defensive with the largest model position now being inflation-protected treasury bonds. Our positioning has allowed us to reduce volatility significantly and greatly outperform traditional stock and bond portfolios. We will continue to follow our indicators and process to adjust risk as new data is presented.

Past performance is not indicative of future results. Other asset classes or investment vehicles may be used in client portfolios and client portfolios may not hold all positions of the model at the same time as the model. This chart and its representations are only for use in correlation to the proprietary timing model by Arkenstone Financial, Registered Investment Advisor. Actual client and All Terrain Portfolio(TM) positions may differ from this representation.

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

- Interest Rates Stabilize, Stocks Bounce - September 6, 2024

Leave a Reply