In a Nutshell: The Dow Jones Industrial Average had its worst first quarter of all time, with real estate and global equities following in its footsteps. Bond yields plummet to new all time lows. Cash and gold provide much needed refuge for investors during these turbulent times.

Domestic Equity: The Fastest Crash Ever

The U.S. stock market has now fallen 30% and has done it faster than any other stock market crash in history, outpacing both the 1987 and 1929 crashes. Many parts of the country have come to an economic halt. These are truly unprecedented times. As a result, clarity about the future of our economy is murky as best, and it seems we are just at the beginning. With the S&P500 down 35% from its peak just six weeks ago, even the 20% relief rally to close out the month didn’t make much of a dent. The 2600-level looks to be an important level for price in the S&P as indicated below. The first attempt to break through it was rejected, so it seems likely we will see prices fall further before another attempt to break through that level. The next significant level of support is in the 2100 region.

We previously wrote about the yield curve inversion concept and how it can indicate a top for stocks. The last seven recessions preceded the inversion (blue rectangles below), and this time around looks to be no exception. While the yield curve certainly didn’t invert last May because a global pandemic was going to show up in the beginning of 2020. However, this does indicate that there was some underlying market stress before the pandemic and may help inform what our recovery time may look like for the future.

It’s hard to keep up with all of the Federal Reserve action from March, but the net result is an emergency response that dwarfs the Fed’s Great Financial Crisis response. Short-term interest rates are at 0% again, and at least $4.5 trillion will be injected into our economy via funding through banks and corporations. The Fed has been given a work-around by the U.S. Treasury to begin purchasing corporate bonds and may end up taking an equity stake in private airline companies. The good news is the Fed has responded much quicker than they did in 2008, which may ultimately assist in a quicker recovery.

Global Equity: Emerging Markets Hit Hard

The broad basket of developing countries fell by 25% in March. The resolution of the multi-year consolidation was finally resolved to the downside. With most of the Asian countries in this basket still far from opening back up after health-related lockdowns, it seems there may still be more downside to be had. Given that many of the countries in the emerging markets sector were first to shutter their economies, they might be the first to reopen, so this sector could be a leading indicator for global activity.

Real Estate: Worse Than Stocks

Real estate needed about three years to make a new high when it did just that in early 2019. About a month was all that was needed to take all of those gains away. From its peak, real estate has fallen 40%, outpacing stocks to the downside. The concerns in the commercial real estate sector are valid. With much of commercial real estate buildings hosting retail, small business, and offices, it doesn’t take much imagination to see the potential fallout in countries on health-related lockdowns. Additionally, with an increased number of employees telecommuting, there is a chance that businesses reassess the value of the traditional office setting in the future. Even if real estate can manage to find a bottom near current price levels, it looks to have a long road to recovery ahead.

Commodities: Gold Provides Protection as Volatility Heats Up

Though gold continues its multi-year outperformance of stocks, the recent ride in gold has been wild. In March, gold fell 10%, then rallied 10%, only to finish down 3% for the month. Not bad given what happened in the stock market over the past month. The volatility doesn’t seem to be going away anytime soon and gold is still above a key support level at about 1560, but that doesn’t mean gold won’t be subject to broad based selling in the future. However, the case for owning gold has only gotten stronger with global interest rates around zero, and global central banks actively devaluing their own currencies against each other.

Fixed Income: Treasury Yields Hit All Time Lows, Again

There isn’t much left to say about bond yields. Short-term rates are near zero. The 10-year treasury bond yield is 0.63%. Here’s what that looks like against the past two decades.

Even the 30-year bond is currently yielding only 1.29%. Below you can see what a 1.29% 30-year yield looks in the context of our last 40 years. Additionally, the arrows indicate major disruptions in the bond markets that coincided with major stock disruptions.

Inflation is now over 2%, which exceeds the yield on any treasury bond, regardless of maturity. This means the real return (yield minus inflation) is negative for U.S. treasury notes. Investors still seem inclined to own these bonds over stocks for the time being.

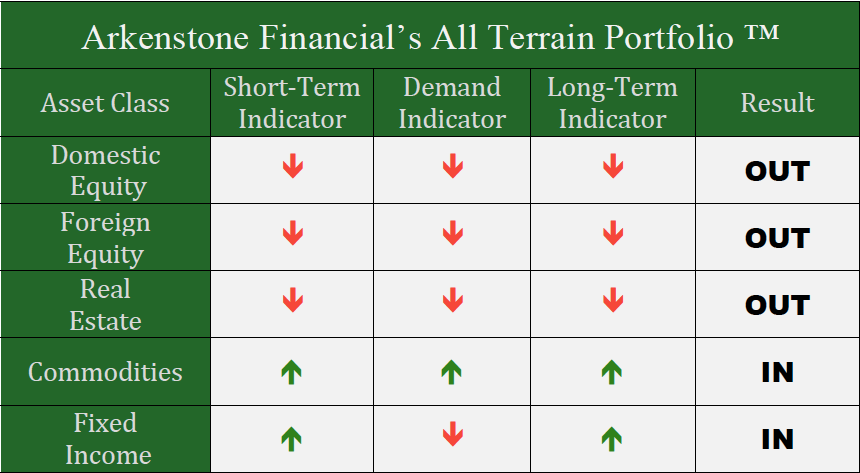

All Terrain Portfolio Update

Though we entered March with a very large cash allocation, additional indicators were triggered and we removed the last remaining equity risk from the portfolio. The All Terrain Portfolio is fully entrenched in capital preservation mode at this time with a large allocation to cash and short-term government bonds.

Past performance is not indicative of future results. Other asset classes or investment vehicles may be used in client portfolios and client portfolios may not hold all positions of the model at the same time as the model. This chart and its representations are only for use in correlation to the proprietary timing model by Arkenstone Financial, Registered Investment Advisor. Actual client and All Terrain Portfolio(TM) positions may differ from this representation.

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply