In a Nutshell: Stocks pull back while commodities and interest rates collapse in response to potential economic impacts from the coronavirus. Central banks across the globe provided ample liquidity in response.

Domestic Equity: Right Now It’s All About the Fed

Although U.S. stocks took a small step back in January, they have been riding a wave of Federal Reserve-fueled liquidity to new highs as of late. The Federal Reserve continues to provide liquidity to markets by printing more dollars and exchanging them for treasury notes with financial institutions. This is a process used by the Fed in the past known as quantitative easing or “QE.” Although the Fed has maintained the situation time around is not QE, this balance sheet expansion is functionally the same as previous QE installments, as evident in the chart below. Below, we have the S&P 500 (top) and interest rates (below) charted with QE start and stop dates overlayed. As you can see, during these periods of QE stocks do quite well and rates increase on the prospect of future growth. However, after QE stops, stocks and interest rates tend to experience significant pullbacks. The hope for investors is that by the time this round of QE is over, economic fundamentals will catch up to these lofty stock prices to provide support.

As mentioned previously, the Federal Reserve continues to provide funding relief to banks on a short-term basis. This short-term funding was supposed to stop at the end of January, but Fed chair, Jerome Powell, recently announced it will continue through April. Additionally, the bond market is now pricing in one to two rate cuts in 2020 despite three rate cuts in the back half of 2019. Needless to say, monetary policy is currently very accommodative in the U.S.

Global Equity: Emerging Markets Hit Hard, Rebound

Emerging markets took a beating to start the year due to the pandemic concerns in Asian countries. However, the Chinese central bank stepped up and implemented a massive monetary stimulus program in response. Markets responded favorably by reversing a trend break (diagonal line) and are now sitting above the highest level of support (top horizontal line). It now becomes a waiting game to see if there are any economic impacts from virus concerns. The private and government responses in China and neighboring countries have been pretty drastic, so economic activity in China is likely to slow. China is the world’s largest exporter, so there will likely be global ripple effects.

Real Estate: Back on Trend

Real estate received a nice boost to start the year. To close out 2019, investors chased a narrative of higher growth and higher interest rates (reflation) because the Federal Reserve was injecting liquidity into the financial system. If the reflation narrative holds, it likely means underperformance from real estate. However, risk assets took a step back and interest rates collapsed to start the year, pushing defensive, higher-yielding assets like real estate back on their trendline for now.

Commodities: The Dollar Is Not Cooperating

The consensus outlook for the dollar in 2020 is that it will fall. This view is rooted in the likelihood of the global economy picking back up, which would likely coincide with a weakening dollar. Unfortunately, the dollar did not get the memo. The dollar has broken through the recent downtrend and looks to have resumed the longer term uptrend. Commodities were rocked by this move in the dollar, with copper and oil testing multi-year lows. As further evidence of its current strength, gold has made a new 52-week high in the face of this dollar strength. A strong dollar will provide challenges to a pick-up in global growth.

Fixed Income: Rates Collapse Again

Last month we mentioned that the bond markets were not reflecting the same economic euphoria that stocks were. Further confirmation of this divergence between bonds and stocks occurred to start the year. Long-dated treasury bonds broke out (below) of their recent consolidation pattern, which can only happen when interest rates fall.

And fall they did. The 10-year U.S. Treasury bond fell through its consolidation pattern (below) hitting the 1.5% level before a modest bounce. The 1.5% level is a level that has been tested numerous times over the last decade and now three times the last six months. Generally speaking, the more a level is tested, the more likely the level breaks. Since a growing economy should see steady or increasing interest rates, defense of the 1.5% level will be very important going forward.

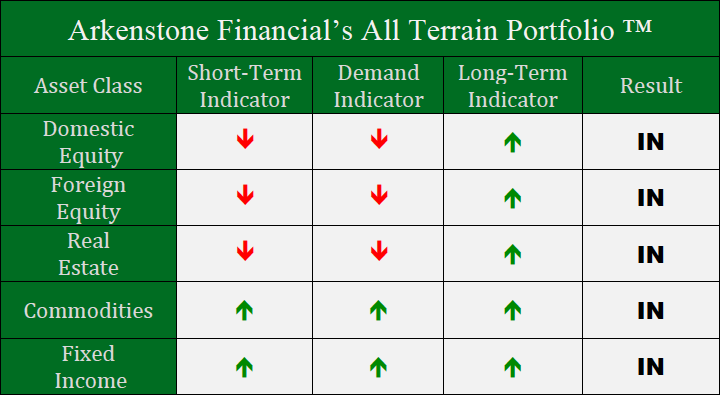

All Terrain Portfolio Update

The All Terrain Portfolio is close to fully allocated at this time as our indicators continue to produce positive results. We’ll continue to watch the data and our indicators for important turning points early in 2020.

Past performance is not indicative of future results. Other asset classes or investment vehicles may be used in client portfolios and client portfolios may not hold all positions of the model at the same time as the model. This chart and its representations are only for use in correlation to the proprietary timing model by Arkenstone Financial, Registered Investment Advisor. Actual client and All Terrain Portfolio(TM) positions may differ from this representation.

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply