In a Nutshell: Stocks and bond yields bounced in September only to give nearly all of the gains back as the calendar turned to October. The U.S. dollar continues to grind higher, putting pressure on the global economy.

Domestic Equity: The Sideways Mess Continues

Stocks bounced in September, only to close the month where they started. The blue horizontal line below shows that the S&P 500 value is essentially the same as it was one year ago. That only tells half of the story, as we’ve seen multiple 10% to 20% pullbacks along with some very strong rallies. All of this underscores the fact that investors are very indecisive and we are stuck in a sideways trend until we see either a breakout or a breakdown.

The Federal Reserve cut rates again in September, making it two straight meetings with a rate cut. According to bond market pricing, the next meeting, set for October 30th, has a 73% chance for another rate cut. Though rate cuts do not always precede recessions, the Fed’s decision to pause rate hikes, then cut rates, looks a lot like the Fed policy decisions preceding the previous two recessions.

Global Equity: Emerging Markets Can’t Breakout

Most of the September bounce in emerging market equities were given back to finish the month. Right on cue, the bounce and pullback were realized within the context of the trend lines we’ve highlighted below. Since the downtrend still hasn’t been bucked, it remains even more important to watch the brief breakdown in August, too, to see if that was a blip on the radar or a sign of things to come.

Real Estate: Continued Success

Real estate continues to appreciate in value and pay a nice dividend. In a low-yield, high-uncertainty investment environment, real estate offers exactly what investors are looking for: higher yield than government debt, with a relatively low correlation to stocks. Until the investment environment changes, expect investors to continue to hold real estate.

Commodities: The Dollar Tells the Global Story

The U.S. dollar continues to push higher, essentially stalling out the global economy. A simplified global investment story can be told through the eyes of the U.S. dollar as follows: A strong dollar puts pressure on foreign exports, so when the dollar bottomed at the beginning of 2018, concurrently, we saw global equities topping. As global equities fell, global interest rates were cut by global central banks to provide relief to ailing economies. U.S. interest rates would fall not soon after to, among other things, prevent the dollar from moving even higher. Since a strong U.S. dollar provides both headwinds and tailwinds to U.S. companies, we’ve seen a flat U.S. stock market since January of 2018. Falling interest rates along with stock uncertainty pushed investors into higher-yielding, defensive sectors like real estate. A little relief from the dollar could go a long way for the global economy.

Fixed Income: Yields Rip, Then Collapse

A wild month in the fixed income markets saw rates bounce only to crash as hard as they bounced to close the month. You’ll see below, our focus is again on the benchmark rate of the ten-year U.S. treasury bond. In the span of about 30 days, we saw this key rate increase by 25% only to fall 21% back near previous lows. The 1.5% yield level for the ten-year note is now looking like some very key support. If that level is broken, it’s likely stocks are not in a good place.

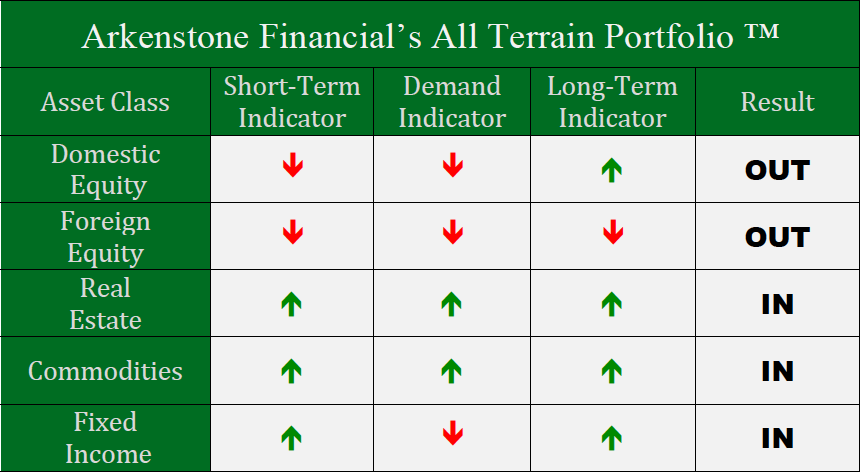

All Terrain Portfolio Update

We’ve taken a more defensive stance while staying within our model parameters in the All Terrain Portfolio as uncertainty and volatility increase following the recent policy shift by the Federal Reserve. We will continue to monitor our indicators for more clarity.

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply