In a Nutshell: In June, stocks rebounded from May lows while bond yields continue to free fall. Real estate continues to be a safe place for investors while gold broke out of a six year base. The big question remains: Which way will the U.S. dollar go?

Domestic Equity: Stocks Rebound

U.S stocks had a strong month in June. In fact, new all-time highs in many major indices were made in June. The real question is whether or not these new high marks can be trusted. The S&P 500 (below) continues to chug along despite divergences with other important subsectors of U.S. markets. The rally in 2019 has been lead by defensive sectors like utilities, consumer staples and real estate, while expansionary sectors like industrials, banks, materials and transports all remain below the high values made back in 2018. Broader sector participation would help confirm this recent breakout has staying power.

As anticipated, the Federal Reserve held rates steady in June. Despite the rise in equities in June, the bond markets have now fully priced in a rate cut on July 31. Another way to say that is the bond market pricing has a 100% probability of a rate cut in July with more cuts to come later in the year.

There is no magic economic indicator, but with rate cuts fully anticipated (while the yield curve is inverted) even the New York Federal Reserve has a very bleak outlook. Their most recent recession prediction model publication has the probability of recession at concerning levels.

Global Equity: Emerging Markets Can’t Decide

The chart below looks much the same as it did last month, with emerging markets still trying to determine their trend. Emerging markets are highly influenced by the U.S. dollar as the two typically trade inversely. As you’ll see in the commodities section below, the U.S. dollar is working on a trend reversal to the downside. If that reversal materializes, emerging markets could break out of the consolidation pattern (shown below).

Real Estate: Steady Growth Continues

Real estate remains the investor’s choice for yield. We’ve mentioned previously that if bond yields are low and falling, those looking for yield will likely flock to real estate. With higher yields than bonds (and most stocks) and a lower correlation to stocks, real estate remains the defensive investor’s favorite hiding place. As you can see below, real estate has held its uptrend following the break out earlier this year.

Commodities: Gold Breaks Out

A huge breakthrough for gold occurred in June as gold finally broke free of its multi-year consolidation. Last month we talked about how this break out was approaching, but June’s price action confirmed the break out as seen in the circled area on the chart below.

Gold tends to be very cyclical, as can be seen in its rally from 2009 to 2011 and its long sustained downtrend from 2011 until recent. Because of how cyclical the yellow metal can be, this recent break out becomes of great importance for another potential multi-year rally.

It seems almost all asset classes are waiting on a move from the U.S. dollar and gold is no exception. A reversal from here would give a boost to gold and emerging markets alike. In the chart below we see a resistance line (horizontal) and a trendline (diagonal) converging. A test and fall of the U.S. dollar at that convergence point would do a lot to confirm a reversal in trend.

Fixed Income: Bond Yields Keep Falling

Will bond yields ever stop falling? For months, we’ve watched the 10-year U.S. Treasury yield fall precipitously. As shown below, we even briefly breached the ever so important 2% level. With yields consistently bumping along the 2% level we are either in store for another fall in yields, or are working on a rebound. Either route is possible, but with the bond markets fully pricing in a rate cut at the end of July, the path of least resistance seems to be down.

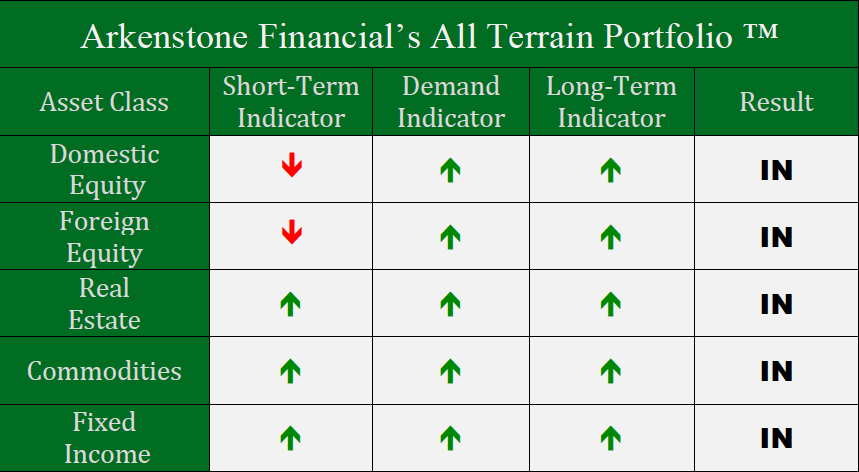

All Terrain Portfolio Update

We are holding the positions from last month in the All Terrain Portfolio, as our indicators continue to be mixed, and the Federal Reserve looks to cut interest rates for the first time since 2007. We’ll continue to err on the side of caution as this major event — the interest rate cut — shakes out.

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply