In a Nutshell: In April, we continued to witness the divergence between stock and bond markets as stock prices rose, while bond yields fell. Real estate and the U.S. dollar continue to show strength.

Domestic Equity: Small Cap Stocks and Financials Join the Party

U.S. stocks continued to chug along in April, with some additional participation from small cap and financial stocks. Large cap stocks had been outpacing small cap stocks for the past few months as small caps struggled to break through resistance as indicated by the blue line below. Assuming small caps can hold the breakout, the broader market could get a boost to the upside from increased market participation.

Another positive sign for U.S. stocks was the financial sector breaking through its downtrend dating back to the start of 2018. We previously identified this sector as an important one that could provide the fuel needed to continue our current market rally. As a key cog in economic growth, the financial sector will be important to monitor going forward.

The Federal Reserve meeting on May 1 confirmed that the U.S. Central Bank has no intention of raising rates this year. The bond markets continue to agree, while remaining steady in their pricing of a greater than 50% chance of a rate cut in 2019.

Global Equity: The German Stock Market Is Looking Strong

Global markets continued to move higher in April. A good example of this growth is the bellwether index for European stocks, the German DAX. Despite all of the uncertainty in Europe, the German Dax continues to grind higher. After completing a massive topping formation in 2017-2018, the index fell below its support of 12,000. The market bottomed out with U.S equities and rallied back, now sitting comfortably above the 12,000 level. If the DAX can keep this up, Europe and other global markets should continue to rise with it.

Real Estate: More Evidence of an Uptrend

Real estate continues to hold up well following its breakout earlier this year. Even during temporary price pullbacks, momentum has remained comfortably in the bullish range. If bond markets are telling investors that yield is going to stay flat or fall, the high-yielding real estate sector should continue to benefit.

Commodities: Will the Dollar Finally Take a Breather?

Betting against the U.S. dollar for the last year has been a fool’s errand. Because of the inverse relationship between the dollar and commodities, it’s no wonder commodities — outside of gold — have suffered so much over the last year. Will the dollar’s reign come to an end? It’s possible, and if it were to happen there is technical support that it will happen soon. The chart below highlights three headwinds: Falling momentum with rising prices; multi-year resistance; and the “rising wedge” pattern than can indicate a reversal in price. Put that all together and a reversal sooner than later would make sense. Time will tell if the dollar will continue plodding along or if a reversal will provide some relief for commodities.

Fixed Income: Yields Can’t Shake the Down Trend

The benchmark interest rate indicator, the 10-year treasury bond yield, continued to show weakness in April. After rallying from March lows and briefly touching 2.6%, the 10-year yield appears to be back on track with its longer term trend, down. If rates continue to fall, expect bond prices to continue to rise.

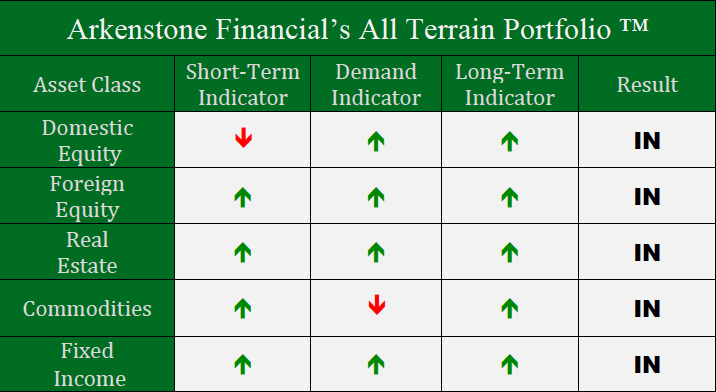

All Terrain Portfolio Update

We continue to monitor our current high-risk investment environment closely as the longer-term market trends shake out. We have added some risk assets to the All Terrain Portfolio this month, but in small and strategic positions with the hope of adding more if trends continue to stay positive.

Past performance is not indicative of future results. Other asset classes or investment vehicles may be used in client portfolios and client portfolios may not hold all positions of the model at the same time as the model. This chart and its representations are only for use in correlation to the proprietary timing model by Arkenstone Financial, Registered Investment Advisor. Actual client and All Terrain Portfolio(TM) positions may differ from this representation.

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply