In a Nutshell: U.S. stocks approach a key resistance level, while global markets finally join the rally. Interest rates remain flat as the Federal Reserve keeps their finger on the pause button, prompting a fresh breakout in real estate.

Domestic Equity: Stocks Face Major Resistance

U.S. stocks have continued to rally off of the December 2018 lows. However, the rally is starting to lose steam at the key 2800 price level as highlighted below. This price level will likely be a battleground and has the potential to shape the rest of the year in U.S. equities. A breakout above this level could provide the strength needed to snap out of this flat, medium term trend we are in. If price stays below this level, then short term price action will likely be down or flat.

One of the U.S. equity sectors that is likely dragging on the broader market is the financial sector. Financials are one of the more strongly correlated sectors when it comes to broader market performance. Currently, the financial sector is acting more like an anchor than a driver. Quite frankly, this is one of the ugliest charts in U.S. stocks. Since it has not made a new high price in over a year, it’s showing characteristics of a sector that is in a downtrend. As you see below, the long-term uptrend that was broken in December of 2018 is on a collision course with the medium term downtrend currently in place. Resolution in this sector, one way or another, will give clarity to the broader market direction.

February featured a lot of chatter from Federal Reserve members, but not much action as interest rates remain flat. Bond markets still have no rate hikes priced into 2019. The positive update from last month is that bond markets are currently pricing in a slightly reduced probability of a rate cut in 2019. The next Fed meeting in March is expected to result in rates staying steady.

Global Equity: Developed Markets Join the Party

Last month we highlighted how emerging markets were leading the global rebound in stocks while developed markets still had work to do. Over the past month developed markets have done the work to buck the downtrend. As you can see below, the blue downtrend has been breached. Some caution is warranted with developed markets however, as a large portion of this sector is Europe. The European Central Bank unleashed another round of stimulus projects, just three months after completing a four year stimulus package, citing low growth expectations. There are a handful of European nations that are in or approaching a recession already.

Real Estate: The Breakout Looks to Be Holding

We previously mentioned the case for real estate in a low interest rate environment. Price behavior continues to support this positive case as real estate broke through a multi-year resistance level last month and has held so far. We follow multiple real estate proxies and they are all telling the same story: Unless prices fall below the support/resistance (blue) line, the trend is up.

Commodities: Is It Time to Take Gold Seriously?

Gold tends to get a pretty bad rap in the investing world. This stems from the fact that gold can be prone to long term secular trends where it can drastically underperform equity markets. However, gold has periods of time where it has drastically outperformed equity markets as well. The chart below highlights what could be the beginning of a strong period for gold. Gold has had a pretty nice run over the last six months, but pulled back in February. When we zoom out we see that gold looks to be completing the final stages of a base that began about five years ago. The key price point to follow is the $130 level as highlighted by the red line below. If gold can breach that level and hold, a long term uptrend will likely be in the works. A basing process that takes a half-decade to resolve has the potential to provide enormous upside.

Fixed Income: Bond Yields Continue to Trend Downward

We continue to monitor the yield of the 10-year treasury note, as it’s a key bellwether in the fixed income markets. As you can see below, there has been some recovery in the yield since last December, but not much. This is to be expected as the Fed has backed off interest rates in the meantime. It’s looking like the 10-year rate will be stuck between 2.6% and 2.8%, with a predisposition to be on the lower end of the bracket. A drop below 2.6% likely spells trouble in the financial markets.

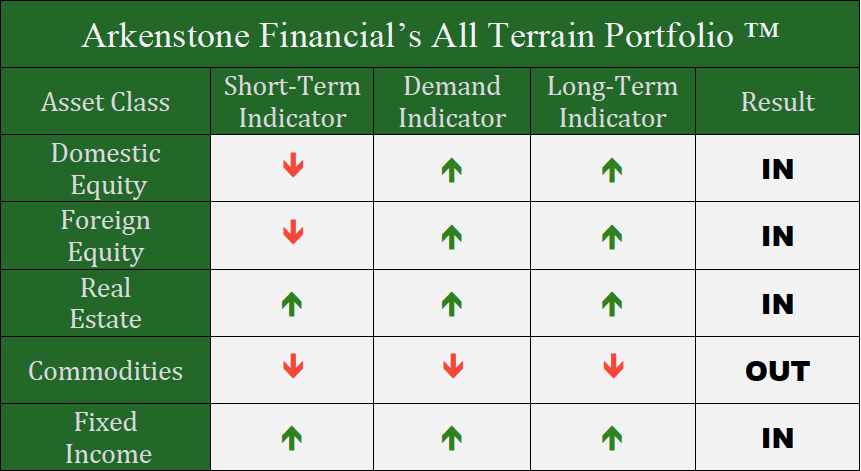

All Terrain Portfolio Update

We continue to monitor our current high-risk investment environment closely as the longer-term market trends continue to shake out. We have added some risk assets to the All Terrain Portfolio this month, but in small and strategic positions with the hope of adding more if trends continue to stay positive.

Past performance is not indicative of future results. Other asset classes or investment vehicles may be used in client portfolios and client portfolios may not hold all positions of the model at the same time as the model. This chart and its representations are only for use in correlation to the proprietary timing model by Arkenstone Financial, Registered Investment Advisor. Actual client and All Terrain Portfolio(TM) positions may differ from this representation.

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply