In a Nutshell: U.S. and global stocks surged to start the year as stocks bounced off of the low marks from the end of 2018 in grand fashion. Meanwhile, the Federal Reserve quickly changed its stance and gave markets what they want: a very accommodative policy outlook.

Domestic Equity: Stocks Bounce, Cheer the Fed

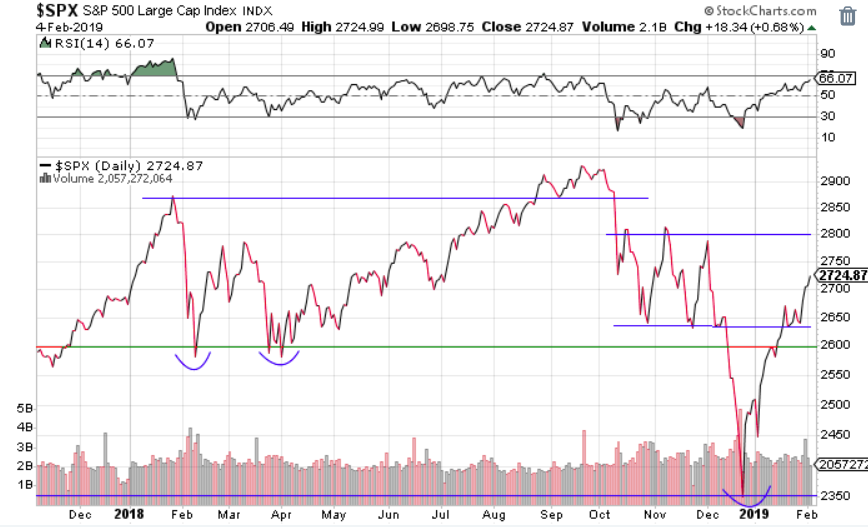

U.S. Stocks rallied with historical strength as major markets indices were up nearly 15% in the month of January. Although the bounce was a welcome sight to beaten down markets, there are greater challenges for investors going forward. Namely, the lack of a currently defined trend. As you can see below, the S&P 500 is sitting at the same price level that it started 2018 despite a wild last few months. Additionally, we are smack dab in the middle of the October high and December low of last year. With a lack of clearly defined trend in place for U.S. equities, the only certainty in the short-term is uncertainty.

Additionally, the bottoming process that defines the majority of market bottoms has yet to be clearly displayed. We only have to look back to the beginning of 2018 to see how this process typically works. In early 2018 stocks fell, bounced, and fell back to the prior lows before resuming the uptrend. Markets don’t have to behave this way, but it is the most common recovery process after a pullback. As you can see below, we just completed a ferocious rally, but have not fallen anywhere near prior lows yet. More clarity should come through time.

What a difference a month (and a 10% fall in equities) makes for Federal Reserve Chair, Jay Powell. Just one month removed from a rate hike and stating his intention to raise rates on multiple occasions in 2019, Powell reversed course. In January, much to the market’s delight, Powell stated that interest rate hikes will be paused for now. As a result, bond markets have zero rate hikes priced into 2019. What is more concerning is that bond markets currently believe (based on pricing probability) that by the end of 2019, there is a higher probability of a interest rate reduction than an increase. This does not mean a recession is imminent, but it’s worth noting the last two rate cuts by the Fed have immediately preceded the last two recessions.

Global Equity: Global Stocks Rebound

Foreign stocks rallied with U.S. stocks in January and clawed their way back above the key resistance level. From a price standpoint, the chart below shows that some strength is building globally among developed nations. They still have work to do, including breaking through the longer term down trend, but overall these are positive developments.

Emerging markets have made a much more convincing bottoming process than their developed market counterparts. Emerging markets have also moved back above a key resistance level and seem to be gaining strength on perception of the U.S. dollar weakening.

Real Estate: Is This Time for Real?

The real estate rally outpaced equity markets in January. It’s no coincidence that the rally coincided with the Federal Reserve stating they will stop raising interest rates. We speculated that real estate could be a big benefactor in this type of scenario as investors would seek the higher yield from real estate compared to fixed income alternatives. As you can see from the chart below, the journey to make it above the key support (top blue line) has been years in the making with multiple failures along the way. Given the history of this sector, we’ll want to see evidence that this price level can be held before diving in. If we get confirmation, this could be a great spot for investors looking for yield.

Commodities: King Dollar Continues to be Stubborn

Commodities are still a bit of a mess and remain below a key resistance price level. The biggest headwind in commodities right now is the U.S. dollar. Since they generally trade inversely, a rising dollar makes it difficult for commodities to rise. Although metals have held up fairly well over the last few months, the broader basket of commodities have not. Below we can see why. The chart shows the painful, slow grind upward from the dollar. Just when it appears it’s about to rollover and breakdown — like we saw last December — support is found, making commodities a headache to own. A fall in the dollar could provide a massive boost to commodities and emerging markets alike. Unfortunately as the chart below demonstrates, we’ve been close to a breakdown, but have yet to see any kind of confirmation.

Fixed Income: Yields Look Primed to go Lower

The small bounce in the 10-year treasury yield through January was quickly beaten down by the Fed’s announcement to pause future rate hikes. You can see that bounce and fall in the chart below. The bottom blue line on the chart highlights the 2.6% yield marker which has been a key level going back to 2016. If we fall below that line, expect bond prices — both government and corporate — to rise.

All Terrain Portfolio Update

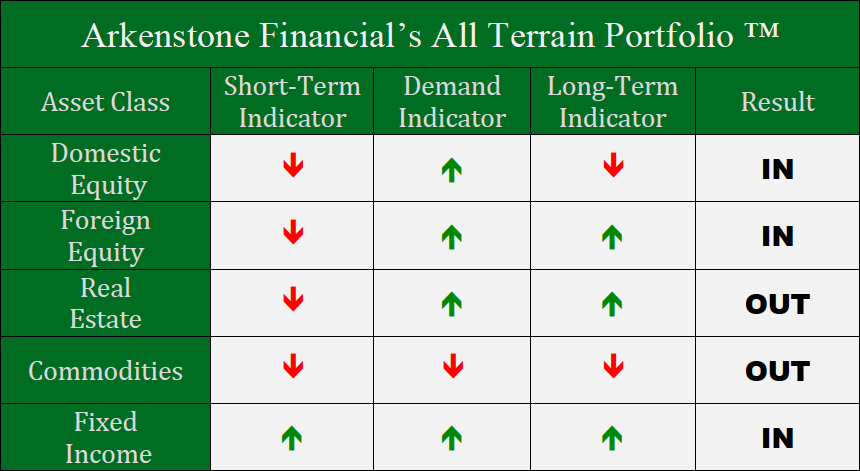

We continue to monitor our current high-risk investment environment closely as the longer-term market trends continue to shake out. We have added some risk assets to the All Terrain Portfolio this month, but in small and strategic positions with the hope of adding more if trends continue to stay positive.

Past performance is not indicative of future results. Other asset classes or investment vehicles may be used in client portfolios and client portfolios may not hold all positions of the model at the same time as the model. This chart and its representations are only for use in correlation to the proprietary timing model by Arkenstone Financial, Registered Investment Advisor. Actual client and All Terrain Portfolio(TM) positions may differ from this representation.

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply