In a Nutshell: U.S. and global stocks continued to fall into the year’s end. Treasury bonds rise, while yields fall, signaling a potential end to this round of Federal Reserve interest rate increases.

Domestic Equity: Stocks Collapse

U.S. Stocks fell over 10% in December, closing at a -6.2% for the year. The chart below points to how we got here and what it means going forward. The trigger for this downtrend was set when the January 2018 high values could not hold. Further confirmation of the downtrend occurred in November, when the S&P 500 consolidated, then continued downward through substantial support. Stocks found a bottom at the 2350 value, but from a technical standpoint, it doesn’t appear to be the bottom. If this current downtrend is going to reverse, it’s likely going to happen after revisiting the 2350 level. If that price level can’t be held, it looks like a long way down for U.S. equity.

As anticipated, the Federal Reserve raised interest rates in December. Although the Fed Chair, Jerome Powell, stated he anticipated raising rates more in 2019, bond markets have no rate hikes priced in for 2019.

Global Equity: Global Stocks Break Key Support

Foreign stocks fell with U.S. stocks in December, breaking a very important price level in the process. Last month we highlighted this key support level and how it had been tested a few times already in the fourth quarter of 2018. With that level now broken, it appears foreign stocks will continue to drop.

Real Estate: Failure to Break Through Resistance

Real Estate fell with stocks to close out the year. We were optimistic that a fall in bond yields would would make real estate more attractive to investors, allowing it to break through the price level indicated by the blue line in the chart below. Bond yields fell, but so did real estate. This asset class appears determined to stay locked into its current trading range for the foreseeable future.

Commodities: Key Support Broken

Commodities fell 8% in December, breaking key support along the way. Although the U.S. dollar weakened a bit in December, it was unable to prevent the oil-lead plunge in commodities. The broader sector is to be avoided until some semblance of a bottom is formed. However, some individual commodities look appealing. Gold and silver are perking up and could be an intriguing option for investors if stocks and the dollar continue to fall.

Fixed Income: Treasury Bonds Surge on Falling Yields

With just about every asset class falling in December, the main benefactor was U.S. Treasuries. This flight to safety is quite common during periods of uncertainty in stocks, but treasuries have an additional tailwind on their side as future Federal Reserve rate hikes seem unlikely. In the dual chart below you’ll see the yield of a 10 year treasury bond above the price of a long term treasury bond. We talked about how important the yield level of the blue line was last month, and yields just continued to fall below that level in December. As you can see below, with yields falling, prices are increasing. Treasury bonds look to be a very good investment for the time being, especially if the Fed is not expected to raise interest rates.

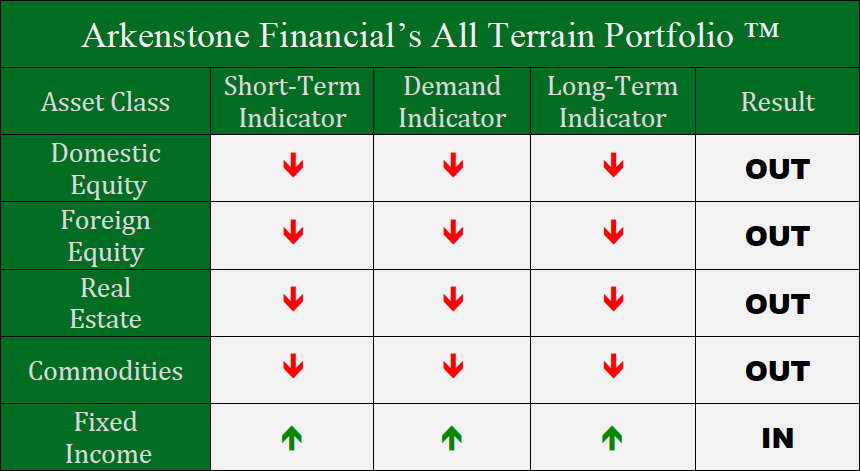

All Terrain Portfolio Update

2018 was a very challenging year for investors. The most staunch evidence of these challenges was the fact that the best performing asset class for the entire year was cash. Let that sink in. Every major asset class was either flat or negative for the year. The All Terrain Portfolio performed as intended, with the primary focus of preserving capital. Heading into 2019, risks remain elevated, and the portfolio will hold a higher than normal portion of cash. Until the markets can prove trustworthy, the portfolio will remain highly risk averse.

Past performance is not indicative of future results. Other asset classes or investment vehicles may be used in client portfolios and client portfolios may not hold all positions of the model at the same time as the model. This chart and its representations are only for use in correlation to the proprietary timing model by Arkenstone Financial, Registered Investment Advisor. Actual client and All Terrain Portfolio(TM) positions may differ from this representation.

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply