Recently we had an opportunity to sit in on a presentation by one of the key economic advisors to the White House and then cross-examine the presenter after.

As a result, we’re going to push our planned comments about how the flattening of the yield curve is usually a reliable indicator of economic slowdown, and an inversion of the yield curve is a strong indicator of recession, to next month.

So, to our report on what at least one portion of the president’s economic team sees in the economy.

His headline is pretty rosy. He sees four or five quarters of greater than 3% annualized economic growth—provided the current trade confrontations don’t choke the world economy.

It’s worth pointing out that only in our conversation following his presentation, when I pressed on the material economic threat trade wars may create, did he acknowledge his presentation had been “Pollyanna-ish.”

In the post presentation interview, he acknowledged the true problems tariffs and trade wars present to global and domestic economic order. He also agreed that his positive economic outlook only stands up if the bluster and negotiating posturing going on among global capitols (particularly between Washington and Beijing) don’t result in loss of control of the negotiations and a full blown trade war.

With that warning, here is my report on one perspective that is part of the conversation in the Oval Office at the White House. Also, a disclaimer, the slides tell an economic story that is valid, but they are labeled and positioned with a very political perspective–that of the current administration and not necessarily ours. We’re only interested in the administration’s perspective to the extent is helps us understand the economic situation and improve our portfolio optimization.

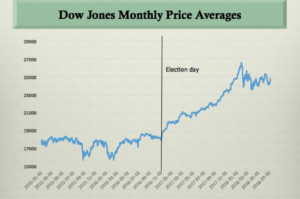

As you might expect the report starts by pointing out the economic and domestic stock market rally that has been underway since the current administration stepped into office.

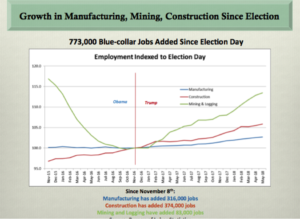

Calls out the growth in business activity, especially in manufacturing, mining and construction in that period.

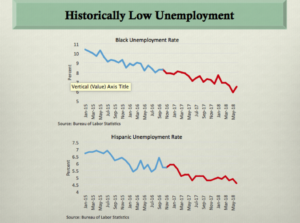

It then turns to the resulting fall in unemployment rates during the same time frame.

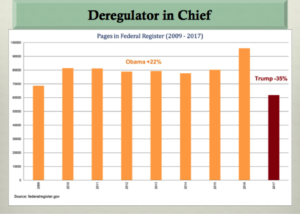

It credits deregulation…

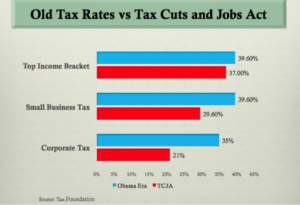

…and last year’s tax cuts for the positive economic markers.

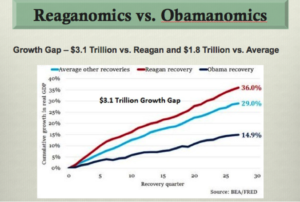

The thrust of the story—and the primary cause to anticipate a continuation of the recent uptick in growth—is told in a graph that shows the underperformance of the economic recovery since the great recession in 2008. That recovery clocked less then 15% growth in 28 quarters while the average recovery showed 29% and the deregulatory and tax cut driven “Reagan” recovery turned in a 36% uptick. The expectation is this recovery will more closely echo that recovery in the 1980’s, which gives it room to run.

Now all this is predicated upon the caveats that I called out earlier in this report. A trade war would tank it all. Let’s hope the presidential advisor I sat down with—who is a free trader and shares my concerns over the current tone of negotiations—has a voice that rings out and is heard as the folks in Washington are mapping out their trade negotiating strategy.

Another threat worth monitoring is a Federal Reserve Bank in a hurry to finally return to more historical rates of interest. The Fed has a history of raising rates and raising rates until they’ve rolled right into a recession. As you know we’ve written recently on how important the credit cycle has become to the contemporary economy, so don’t underestimate the risk Fed action presents as well. We’ll have more on that next month.

- Inside the Bubble in Washington D.C. - August 22, 2018

- Paul’s Perspective – Through the Looking Glass of New Economics - June 21, 2018

- Paul’s Perspective – Will the Retirement Boom Be a Bust for Equities? - May 23, 2018

Leave a Reply