Technology pushes U.S. stocks higher and global stocks follow suit. Commodities continue to face major resistance through currency and tariff battles.

Domestic Equity

U.S. Stocks continued their steady recovery this month with a 3.7% gain in July. More importantly, the S&P 500 has started to approach and test the record high marks set this past January. Should the S&P 500 break through and hold the January highs, markets should be primed to run even further. The technology and healthcare sectors were very strong in July, and the financial sector has recently shown signs of life as well. U.S. GDP for Q2 was reported at 4.1% in July, the highest mark in nearly four years.

As anticipated, the Federal Reserve held interest rates steady in July. Currently, markets have priced in a 94% probability of one more rate hike (in September) and a 70% chance we see hikes in both September and December this year.

Global Equity

Foreign stocks followed the U.S.’s lead, clocking in a 3.9% gain for the month of July. Although global stocks are still negative for the year, July’s positive movement was a welcome sight – a strong U.S. dollar and ongoing trade negotiations have been headwinds in 2018 for global stocks. Emerging markets outperformed developed stocks in July with Brazil, who appears to reap the most benefit from the tariffs applied to China, leading the pack.

Real Estate

Real estate cooled off a bit in July, but still added another 1% of growth for the month. Real estate is facing some very strong price resistance in the short-term. Should real estate break through and hold this resistance, this sector should have room to run in the second half of 2018. In the meantime, the dividends alone should keep investors interested in this sector.

Commodities

Commodities, which have been plagued by tariff talk and a strong dollar, lost another 3% overall in July but ultimately reversed course by the end of the month. Oil has been relatively strong, but precious metals have continued to fall precipitously over the last few months. Although relief from the strength of the dollar appears to be in sight, it has not come to fruition, making commodities tough to trust.

Fixed Income

Bonds were flat for the month, continuing a years-long sideways pattern. Fixed income remains a tricky investment environment. Bond yields are still low when compared to U.S. stock indices, and with bonds struggling to hold their value many investors have opted to look elsewhere. Long-term treasuries have been building on a pattern over the last few years that looks like it could resolve itself by the end of the year. The resolution should provide clarity, whether it results in an up or down move for treasuries.

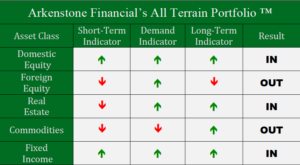

All Terrain Portfolio Update

The All Terrain Portfolio carries its cautious investment approach into August. Although we witnessed a few short term positives in July, we will continue to closely monitor our indicators, key support, and technical levels.

Past performance is not indicative of future results. Other asset classes or investment vehicles may be used in client portfolios and client portfolios may not hold all positions of the model at the same time as the model. This chart and its representations are only for use in correlation to the proprietary timing model by Arkenstone Financial, Registered Investment Advisor. Actual client and All Terrain Portfolio(TM) positions may differ from this representation.

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply