U.S. stock markets are quietly building momentum following a months-long consolidation period. Global equities, meanwhile, lag behind.

Domestic Equity

U.S. stock markets saw modest gains of around 3% for the month of May. More importantly, domestic stocks have broken out to the upside of the consolidation pattern that had been forming over the previous months. Generally speaking, when long-term trends are intact, periods are consolidation are followed by a continuation of the the long-term trend. This means with our current trend intact we should see positive market trends resume in the short-term. Technology and small cap stocks led the way in May, while banks and consumer staples lagged behind.

As anticipated, the Federal Reserve held interest rates steady at its May meeting. The minutes released from this meeting did nothing to clarify the number of remaining rate hikes for 2018. Investors are split on whether we see two or three more hikes this year. Currently markets are pricing in a 90% chance that the Federal Reserve raises rates in June.

Global Equity

Foreign markets have yet to awake from their slumber, lagging behind the U.S. Broad global equity indices and unable to break out their consolidation patterns and posted slight losses last month. Additionally, they appear to be content to stay in a flat, sideways pattern while testing, (and breaking, in some cases) long term trends — not an encouraging development. Over the last few years, global equities have enjoyed concurrent success with U.S. equities, but we are seeing some early indicators that this relationship may be fraying.

The development of foreign equities decoupling from U.S markets can be seen even more clearly in emerging markets. Emerging markets continue to show weakness and have been unable to shake their recent downward trend. The sudden rebound of the U.S. dollar has put additional pressure these developing economies. On a global scale, this is not an encouraging sign, especially as central banks across the globe take their foot off the gas pedal.

Real Estate

Real estate continues its strong rebound. This sector saw a three percent gain in the month of May. Although real estate pays a nice yield (around 5% annually) in a low yield investment environment, investors will want to approach real estate with some caution. Real estate broke a long-term trend at the beginning of this year, making this recent rally a little more difficult to trust.

Commodities

Commodities saw a modest gain of 2% in the month of May. That may not seem like much, but considering these gains were realized while the U.S. dollar was rising, it makes it all the more impressive. Generally commodities trade inversely with the dollar. Commodities have seen solid growth for nearly a year now.

Fixed Income

May was about as wild as it gets in the fixed income markets. The ten year treasury note yield spiked to 3.11% in Mid-May. This spike marked the highest yield ten year treasuries have seen since 2011. As we’ve noted previously, as interest rates increase, underlying bond values decrease. This brief spike in interest rates put downward pressure on treasuries values, causing intermediate term treasuries to briefly break down. Ten year rates stabilized by the end of the month and treasuries returned back to their mostly flat pattern. We will closely watch the fixed income markets as more interest rates appear set for 2018.

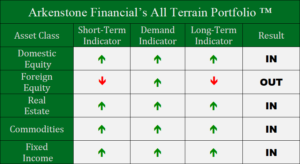

All Terrain Portfolio Update

The All Terrain Portfolio carries its cautious investment approach into May. Although we witnessed a few short term positives in May, we will continue to closely monitor our indicators, key support, and technical levels. We will maintain this approach until greater clarity and direction is established.

Past performance is not indicative of future results. Other asset classes or investment vehicles may be used in client portfolios and client portfolios may not hold all positions of the model at the same time as the model. This chart and its representations are only for use in correlation to the proprietary timing model by Arkenstone Financial, Registered Investment Advisor. Actual client and All Terrain Portfolio(TM) positions may differ from this representation.

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

- Interest Rates Stabilize, Stocks Bounce - September 6, 2024

Leave a Reply