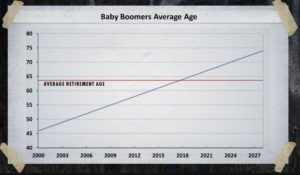

Baby boomers are retiring at a ferocious rate. Fifty million are expected to retire in the next several years. Because life expectancy keeps extending and individuals are concerned they may outlive their cash, it’s a bit of a moving target as people delay retirement. But the demographic trend is clear. The largest and richest generation is shifting from the most powerful economic driver in history to a drag on the economy. That’s not a personal judgment. It’s simply a reality. People spend substantially less in retirement than they do when are raising families and accumulating the things of life.

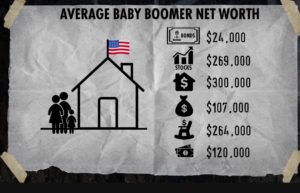

And the drag on the economy will be exaggerated by the fact that most people are not financially prepared to retire. The picture doesn’t look too bad when you consider the average baby boomer net worth. It’s nearly $1 million.

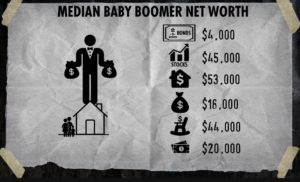

But to get an accurate picture of the demographic impact coming our way you must strip out the extreme wealth of “the one percent.” The picture presented of median baby boomer net worth estimates portends a coming economic challenge — for those who will find they don’t have enough with which to retire, and the economic drag the required reduction in spending by these individuals will have on the broader economy.

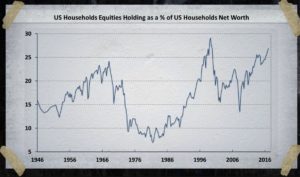

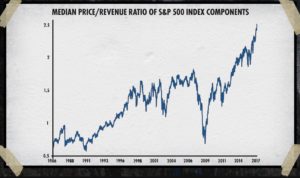

Since the Great Recession, and the Federal Reserve’s intervention into the marketplace with zero and near zero interest rates, more and more dollars have flooded into equities and equity like products to find return. The traditional balance for individuals nearing retirement, which tends to include a larger portion of bonds and other fixed income investments has—across the broad array of American and international investors—been skewed toward portfolios over-weighted with equities.

And this expanded allocation into equities comes at a time when many analysts believe equities are overvalued.

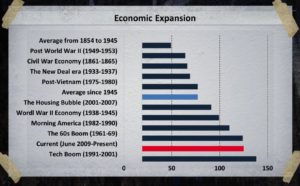

All this comes at a time when the economic expansion has achieved the status of the second longest in history and is fast approaching the longest in history. It may run for several more months, or a couple more years, but the economic expansion is about to make history.

What is spectacular about this timing is the intersection it presents between the massive number of individuals who are retiring and therefore tapping their foot on the brake pedal of economic expansion, and a market that is arguably overvalued and past due for a correction. The combined effect may be dramatic and sustained. Because the now retiring baby boomers make up such a large part of the economy and they are reducing their spending habits, any downturn will likely be an extended downturn.

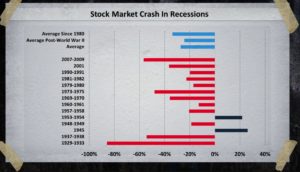

The above chart shows what historical corrections have looked like.

Although we can’t predict anything, the outsized macroeconomic trends that may come to bear in this next economic and market correction are certainly worth considering. So, at Arkenstone Financial we remain vigilant. We consistently research and routinely update our trend following strategies designed to participate in positive market moves and at the same time manage risk. And, we keep you informed.

If you’ve got questions or want to expand on this conversation give us a shout.

- Inside the Bubble in Washington D.C. - August 22, 2018

- Paul’s Perspective – Through the Looking Glass of New Economics - June 21, 2018

- Paul’s Perspective – Will the Retirement Boom Be a Bust for Equities? - May 23, 2018

Leave a Reply