Global stock markets offered investors a reprieve in April. Most stock markets around the world were unchanged for the month while volatility all but disappeared.

Domestic Equity

After a chaotic start to the year for U.S. markets, April brought some semblance of calm: U.S. stock market indices were essentially flat across the board this past month. The higher volatility that become a fixture in markets for the first quarter of this year also took a breather. Although markets were subdued, they continued building on their 2018 patterns. U.S. stocks continue to show good support on recent low values. However, a downward trend in local high values continues to develop, which means markets are failing to make or match new high values. The two trends should come to a head in the next few months to provide some direction and clarity for the rest of 2018.

It is anticipated that the Federal Reserve will hold rates steady at its early May meeting. Current market probabilities indicate that two to three more interest rate increases will occur this year. The May meeting minutes could provide some clarity on the Fed’s future plans, but as of now there is a greater than 90% chance of a June rate hike priced into markets.

Global Equity

Foreign markets saw much of the same month as the U.S. did in April with flat markets and reduced volatility. Europe has experienced recent signs of slowdown as the continent is on the cusp of the European Central Bank wrapping up their large monetary stimulus program. In fact, Mario Draghi, the president of the ECB, hinted they may extend the program through the end of 2018. Draghi had previously stated the program would wind down in the fall of this year.

The most significant development in global markets are the recent emerging market movements. Emerging markets, which include China, have been in a very strong bull market pattern since early 2016. Emerging markets are now displaying a willingness to break this pattern—a breakdown which, if realized, would have global implications. We’ll continue to monitor this situation.

Real Estate

After a brutal start to the year, real estate is beginning to regain its footing. Not surprisingly, this recent strength has occurred simultaneously with falling bond prices. Investors are still looking to use real estate investments as bond substitutes, and real estate is still paying yields that exceed U.S. Treasuries and investment grade corporate bonds.

Commodities

Commodities saw modest gains in April, following a slow start to the year. Commodities continue to stay locked into a channel of growth that can be dated back to the middle of 2017. Oil continues to buoy the broader basket of commodities, with gold providing support as well. Surprisingly, commodities were hardly affected by the surge in U.S. dollar to close out the month, despite the fact that commodities and the dollar typically trade inversely.

Fixed Income

April saw more of the same in the fixed income market. Prices continued to fall, while yields increased. After a break from this trend in March, bonds are back in their nearly year-long pattern. The ten year treasury note saw its yield briefly touch three percent at the end of April—the highest it’s been in nearly five years. On the surface, the recent spike in yield sounds like a good thing, and that concerns of yield curve inversion (which occurred prior to the last nine recessions) were overblown. To the contrary, this recent spike puts us at the top of a yield cycle that is nearly three decades in the making for the 10 year note. Meaning, if this 26 year trend continues, long-term treasury yields are set to fall even as the Federal Reserve pumps up short-term rates. Is this the perfect storm for yield curve inversion? Or the beginning of the breakdown of a long-term trend for U.S. treasury yields. Time will tell, and we’ll keep a close eye on these developments in the meantime.

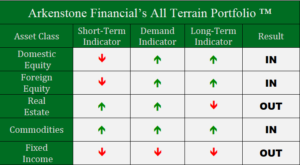

All Terrain Portfolio Update

The All Terrain Portfolio carries its cautious investment approach into May. We will continue to closely monitor our indicators to test key support and technical levels. We will maintain this approach until greater clarity and direction is established.

Past performance is not indicative of future results. Other asset classes or investment vehicles may be used in client portfolios and client portfolios may not hold all positions of the model at the same time as the model. This chart and its representations are only for use in correlation to the proprietary timing model by Arkenstone Financial, Registered Investment Advisor. Actual client and All Terrain Portfolio(TM) positions may differ from this representation.

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

- Interest Rates Stabilize, Stocks Bounce - September 6, 2024

Leave a Reply