Uncertainty dominated global stock markets in March. Volatility remains high, and markets continue to pull back. Here are the takeaways from each market sector.

Domestic Equity

“In like a lion, out like a lamb” is generally associated with the way spring comes and goes. U.S. stock markets were greeted with their own lion-like ferocity as the calendar turned over to March. Although domestic markets only lost about 2% over the course of the month, those who were paying close attention would argue the losses felt much worse—a feeling that can be attributed to the recent spike in market volatility. Current volatility looks especially stark when compared to an extraordinarily calm 2017. In fact, there have already been 27 trading days in 2018 on which the Standard & Poor’s 500 stock index has closed up or down by more than 1%, compared to just eight days in all of last year, according to S&P Dow Jones Indices.

Although geopolitical conflict and trade wars dominated March headlines, the Federal Reserve provided plenty for investors to consider. As anticipated, interest rates were increased by 0.25% in March. This marks Fed President Jerome Powell’s first rate hike in as many opportunities. Interestingly, this hike occurred at a time of stock market turmoil. Over the last decade, the Fed has typically been accommodating to markets in such times. Interest rate hikes (accompanied by the promise of two more hikes in 2018) marks a distinct shift in approach for the U.S. Central Bank.

Global Equity

Volatility varied substantially from country to country during March. Outside of the U.S., most developed countries’ stock markets saw minimal losses and lower volatility. Some emerging markets, like China, experienced the same rocky ride as domestic markets. China’s wild month can likely be linked to the fact that the country’s economy is the target of many of the United States’ imposed tariffs. China seems willing to give as good as they get, making it likely conditions will get worse before they get better for the markets currently involved in these trade wars.

Real Estate

Real Estate rebounded after an awful month in February to post a modest 2.5% gain in March. The global stock market continues to sell off, leaving investors looking for safety and high yields. The real estate sector still retains attractive yields when compared to fixed income, and the instability of the bond market may continue to push investors to real estate as an alternative to stocks.

Commodities

Commodities were flat for the second month in a row. Although commodities could be impacted by tariffs—China just imposed a massive tariff on soybeans—it’s more likely that the U.S. dollar will impact commodity price movement. Unsurprisingly, the dollar was flat in March as well. On the bright side, the major players in the commodities sector, gold and oil, saw modest gains in March and will likely not be impacted by any tariffs going forward.

Fixed Income

Bond prices increased for the first time since last August. While this may seem like a good thing for the fixed income market, it might not be so great for the broader investment market. Bond prices move inversely with bond yields, meaning our recent bond price increase came at the expense of yields (which were already low, historically speaking). Not only that, yields decreased over longer term maturities (10 year and up) in the same month that the Federal Reserve increased rates. Is this phenomenon simply a result of stocks selling off and investors piling into bonds, pushing up their price? Or is it the bond market calling the Federal Reserve’s bluff on more rate hikes in 2018? Either way, bonds are indicating our short-term investment environment is sub-optimal.

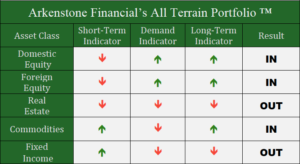

All Terrain Portfolio Update

The All Terrain Portfolio continued to carry a higher than normal cash allocation into April. This allocation has allowed the portfolio to be less impacted by market volatility. We will continue to closely monitor our indicators as markets continue to test key support and technical levels. We will continue to maintain this allocation until greater clarity is found.

Past performance is not indicative of future results. Other asset classes or investment vehicles may be used in client portfolios and client portfolios may not hold all positions of the model at the same time as the model. This chart and its representations are only for use in correlation to the proprietary timing model by Arkenstone Financial, Registered Investment Advisor. Actual client and All Terrain Portfolio(TM) positions may differ from this representation.

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply