After a euphoric start to the year for stocks across the globe, February saw stocks come crashing back down. Although many of the losses have been recovered, volatility remains.

Domestic Equity

U.S. Markets saw a 10% loss by the second week of February. While the markets made a nearly full recovery by the end of the month, volatility, which can be thought of as the range of values witnessed through a trading period, has picked back up. The more indices vary in price in both an upward and downward direction, the more volatility can be observed, and is generally more apparent in times of uncertainty. Inflation concerns, trade wars, and interest rate hikes seemed to have stirred markets back to life after months of nearly no volatility whatsoever.

New Fed Chair Jerome Powell has done his part in shaking up markets by talking tough since taking over the position in early February. He has indicated that the Federal Reserve will increase interest rates four times in 2018. Taking such an aggressive approach to rate hikes so late in our economic growth cycle has sparked concerns that inflation is around the corner for the U.S. economy and the Fed is trying to get out in front of it. Time will tell as the Fed has struggled to hit their modest goal of 2% inflation for most of the last decade. Powell will have his first opportunity to raise interest rates at the March 21st Fed meeting. Currently, markets are valued to represent an 87.6% chance that interest rates will be raised by 0.25% at this meeting.

Global Equity

Foreign stocks suffered the same fate as U.S. stocks, pulling back as much as 11% over the first few days of February. Unfortunately, the rest of the world has not rebounded quite as quickly as the U.S. Generally speaking, global stocks have recovered less than half of their losses during the early February plunge. For example, China’s markets are still hovering just 3% above their February lows. Throw in global trade concerns, and it’s easy to see why investors are wary of piling back into foreign stocks.

Real Estate

Real estate was surprisingly flat for the month as major stock markets plummeted. Real estate investments had experienced significant losses in months prior, so its possible their lower values and still high yields led investors to seek safety in real estate while stocks fell. However, interest rate hikes don’t project well for real estate investments over the long haul. A lot of the recent attractiveness of the real estate sector was its high yield when compared to bonds, but as bond yields continue to rise, real estate will likely continue to fall out of favor.

Commodities

Commodities were flat for the month of February. The U.S. dollar, which generally trades inversely to commodities, was also flat for the month, putting a temporary stop to a months-long decline. The decline in the dollar has fueled recent commodity price appreciation. Interest rate hikes can strengthen the dollar, but inflation can do the opposite. We will continue to monitor the commodities sector closely as policy changes are made.

Fixed Income

Bond prices continue to fall as more anticipated rate hikes are around the corner. As a general rule, bond value (price) moves inversely with their yields. As interest rates rise, new issue bonds will carry a higher yield resulting in older bonds selling at a discount, or reduced price. This type of environment makes fixed income investing difficult as the value of a bond will decrease soon after purchase if interest rates continue to rise.

An additional concern in the bond market is its relation to the stock market, which is still near all time highs. Generally, if stocks fall, investors flee to investments that are considered safer, like bonds. That kind of demand should support or increase bond prices. What we saw in the beginning of February was concerning because bond prices fell along with stocks. If bond cannot provide safety when stocks fall, investors may find themselves in a difficult position.

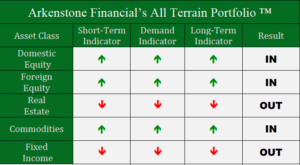

All Terrain Portfolio Update

The All Terrain Portfolio continued to carry a higher than normal cash allocation through February and into March. This allocation allowed the portfolio to be impacted less by market volatility. We will continue to maintain this allocation until greater clarity is found.

Past performance is not indicative of future results. Other asset classes or investment vehicles may be used in client portfolios and client portfolios may not hold all positions of the model at the same time as the model. This chart and its representations are only for use in correlation to the proprietary timing model by Arkenstone Financial, Registered Investment Advisor. Actual client and All Terrain Portfolio(TM) positions may differ from this representation.

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply