In the first month of 2018, global and domestic stocks picked up where they left off in 2017, and then some. Stock markets across the globe grew at a rate that exceeded even the strongest months of last year’s rally.

Domestic Equity

U.S. Markets picked up an impressive 6% of growth in the first month of 2018. The growth continues as excitement over the recent tax policy measures lingers. Enthusiasm for stocks has reached a point of concern, however, as the short-term buying metric, relative strength indicator (RSI), clocked into U.S. indices at a score of 90 on a scale of 0 to 90. This score would indicate that the current growth is unsustainable.

The Federal Reserve, as expected, made no changes to interest rates at their January meeting. Fed Chair Janet Yellen got to hold rates steady for one last time as her tenure as the head of the Fed came to a close. She hands the reins over to Jerome Powell, who looks to continue the path of current central bank policies. The Federal Reserve members have been talking uncharacteristically tough, indicating they will raise rates three to four times in 2018 regardless of market conditions. They will attempt multiple rate hikes while reversing course on their quantitative easing initiative lead during the recovery from the Great Recession. Make no mistake about it, the Fed is tightening the monetary environment in the United States. Traditionally, investors have not responded positively to this kind of environment.

Global Equity

Foreign equities followed the U.S. equity’s “melt-up.” Stocks grew at a frenzied pace as excitement surrounding the prospect of a fresh surge in global economic growth spilled across the globe. Emerging and developed markets grew in lockstep at a 5% clip in January. Many global banks are still applying a monetary stimulus package as these foreign countries continue their slow recovery, an item that may be appealing to investors as the U.S. enters their tightening phase.

Real Estate

Real estate looks to be one of the few losers in our current post-tax cut investing era. Real estate lost significant ground in the first month of 2018 after over a year of maintaining a holding pattern, while paying big dividends. It seems with all of the talk around increasing interest rates, investors have lost their need for bond proxies, like real estate. With the anticipation of more higher yielding investment choices, Real estate has fallen out of favor with investors.

Commodities

Commodities enjoyed a nice start to the year. The broad basket of commodities continue to see positive results as the U.S. dollar continues to tumble. Since the two investments generally trade inversely we anticipate this growth in commodities to continue, unless there is a reversal from the dollar. Oil was the headliner in January for this segment with 10% gains in the month.

Fixed Income

Bonds have become a bit of a mess over the last few months. Caught in no-man’s-land, bond values continue to fall while producing sub-par yields. This double-edged sword puts investors in a tough spot with interest rates on the rise. Hold the bond with a low rate, or sell it at a discount? Investors are choosing the latter, since current yields are so low. With the anticipation of the Federal Reserve continuing to raise rates in 2018, current issue bonds will continue to lose their value when compared to new issues.

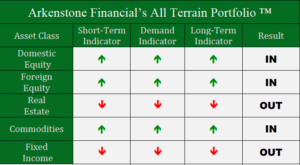

All Terrain Portfolio Update

The All Terrain Portfolio allocations received some substantial changes in January. We head into February with significantly higher level of cash in the portfolio, as a few of our investment sectors are flashing red. We remain highly cautious in this seemingly overheated investment environment.

Past performance is not indicative of future results. Other asset classes or investment vehicles may be used in client portfolios and client portfolios may not hold all positions of the model at the same time as the model. This chart and its representations are only for use in correlation to the proprietary timing model by Arkenstone Financial, Registered Investment Advisor. Actual client and All Terrain Portfolio(TM) positions may differ from this representation.

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply