Global markets took the lead in March, posting their best start to the year since 2012. U.S. markets rode all time highs into the month, but a Federal Reserve interest rate hike and political uncertainty ultimately set up a modest pull back for the month.

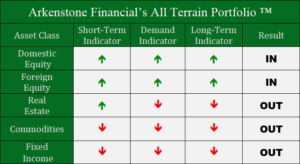

Domestic Equity

U.S. stocks, fresh off all-time highs, slowly tumbled prior to the Federal Reserve’s decision to increase interest rates. This decision was widely anticipated, and was accompanied by Fed Chair Janet Yellen signaling two more anticipated hikes for the year. Interestingly, markets reacted positively after this rate hike. Generally, markets have reacted negatively to the idea and execution of Fed rate hikes, so this represents a distinct shift in sentiment.

Perhaps the market enthusiasm for rate hikes accompanies the excitement around economic initiatives President Trump promised during his campaign. The idea of these economic initiatives has been a major driver in stock market growth since his presidential victory last fall. That excitement took a hit in March as Trump’s Affordable Healthcare Act deal failed, casting doubt on the potential success of the President’s future plans for tax reform. Domestic equity indices responded by falling steadily into the close of the month.

Foreign Equity

Global markets enjoyed another steady and positive month. This month’s gains cap off what has been a great start to the year for the sector. Although there is still a great deal of uncertainty in Europe and Asia, investors seem to be banking on the idea that fiscal policy in the U.S. could spur growth both domestically and internationally.

Real Estate

Real estate pulled back from its recent six month high as the anticipation of the March Fed rate hike hit this sector the hardest. As a high yield investment in a low yield investment environment, real estate can be heavily impacted by rising interest rates – a situation we witnessed in March. However, real estate eventually stabilized, finishing the month slightly negative.

Commodities

Oil was the primary driver of the losses observed in the commodities market. Despite a weaker dollar in March – which generally helps commodities – and an increase in the price of gold, commodities fell about 3.5%.

Fixed Income

Bonds, both corporate and government, saw modest gains on the heels of the interest rate increase this past month. With bond yields still very low by historical measures, investors are content looking else where for yield. A renewed positive outlook for domestic and international stocks has this sector currently out of favor with investors.

Past performance is not indicative of future results. Other asset classes or investment vehicles may be used in client portfolios and client portfolios may not hold all positions of the model at the same time as the model. This chart and its representations are only for use in correlation to the proprietary timing model by Arkenstone Financial, Registered Investment Advisor. Actual client and All Terrain Portfolio(TM) positions may differ from this representation.

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply