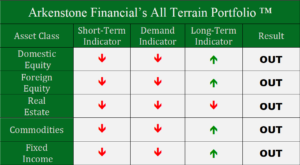

The uncertainty surrounding the U.S. presidential election has injected concern into markets both domestic and abroad. As a result, all major asset classes were negative for October.

Domestic Equity

U.S. stocks fell sharply to close out October. In fact, domestic equity carried an nine day losing streak into early November. Such a streak has not occurred since 1980.

For the first time in years the Federal Reserve took a backseat in the U.S. stock market conversation. The Fed’s November 2nd decision to not raise interest rates was merely a formality as no hike was expected given the decision’s close proximity to the presidential election next week. The Fed meeting minutes did, however, suggest a December rate hike. The Fed raised rates last December as well, making it the only rate increase since rates went to zero nearly a decade ago. However, given the low correlation between the Fed’s words and actions, a December rate hike far from sure thing.

The U.S. presidential election has been the main focal point for investors for the last few weeks. The race has tightened immensely in recent weeks, setting investors on edge. Generally, uncertainty creates fear for investors and each candidate brings their fair share of uncertainty. Regardless of who becomes the next president, investors appear wary.

Foreign Equity

Global stocks were down over three percent for the month of October. Although U.S. election uncertainty has an effect on global markets, Europe was the focal point this past month.

Europe has its hands full with the Italian banking crisis and the Deutsche Bank meltdown. The latter of the two has somehow gone relatively unnoticed, but Deutsche Bank is Europe’s fourth largest bank and is currently doing it’s best Lehman Brothers impression. Over the last 15 months Deutsche Bank’s stock has fallen over 60 percent and solvency has recently become an issue. The European Central Bank has already stated they do not have the capacity to do a bail out, like the Federal Reserve did with U.S. banks in 2007 and 2008. The European Banking system is quite fragile right now, to say the least.

Real Estate

Real estate took another beating in October, with a repeat of September’s five percent fall. It looks like the fun has come to an end in the real estate investment world. Real estate investments have been popular for their high paying dividend in the current yield-scarce environment. The real estate cycle may or may not be coming to an end, but the anticipated interest rate hike in December has many investors cashing in their chips.

Commodities

Despite a modest performance in gold for the month, commodities were negative for the month. Oil again provided the downward pressure as the OPEC production freeze has yet to reach agreement. As a result, oil gave back about 16 percent in October.

Fixed Income

The bond index we follow was down slightly for the month. Bond pricing is interest rate sensitive, so the anticipated December rate hike has had a slightly negative effect on bond prices as of late. Like all sectors we follow, the upcoming presidential election has dampened investors’ appetite for risk. Bonds are no exception.

Past performance is not indicative of future results. Other asset classes or investment vehicles may be used in client portfolios and client portfolios may not hold all positions of the model at the same time as the model. This chart and its representations are only for use in correlation to the proprietary timing model by Arkenstone Financial, Registered Investment Advisor. Actual client and All Terrain Portfolio(TM) positions may differ from this representation.

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply