The Federal Reserve punted on an interest rate hike again in September. As a result, any future rate hike has likely been pushed off to December. Markets have resumed their holding patterns since the Fed’s decision and were slightly down for the month.

Domestic Equity

U.S. stocks entered September on the rise as they briefly reached record highs before falling sharply almost immediately. Ultimately, domestic stocks had a very choppy and highly volatile month, finishing slightly negative.

We would be remiss if we didn’t discuss the Federal Reserve’s decision to not raise interest rates. Astonishingly, the Fed’s decision to raise (or not) interest rates by one quarter of one percent has held global markets captive for all of 2016, as evidenced by the relatively flat market performance this year and the intense media coverage of all Fed decisions.

Because there is no Fed meeting in October, the next chance to raise rates will be just days before the presidential election. It’s highly unlikely the Fed takes action so close to the election. Oddsmakers have a December interest rate hike as the most like scenario for 2016. This, in conjunction with markets hovering near all time highs for almost 2 years, interest rates near zero, and global growth concerns puts our next president in a challenging position to say the least.

Foreign Equity

Global stocks outperformed domestic stocks slightly in September, finishing flat for the month. Because of similar central bank intervention across the globe, foreign equity has closely paralleled U.S. stocks.

It was Japan’s turn on the monetary policy merry-go-round in September. The Bank of Japan announced they would continue to purchase assets to keep their ten year note at 0% yield as it slipped into negative territory earlier this year. Japan has been purchasing assets, including stocks, to stimulate economic growth. It’s estimated that the Bank of Japan owns more than half of all the exchange-traded fund assets in Japan.

Real Estate

Real estate took a beating in September, falling nearly 5% for the month. Real estate, as we’ve suggested previously, has been popular because of its high dividend payouts. With interest rates near zero, creating low bond yields, investors are going to non-traditional investment options to find higher yields. Common logic would suggest that these investments would fall out of favor when interest rates rise. Perhaps this is an early signal from investors that a rate hike is coming at the end of 2016.

Commodities

Commodities were up for the month of September. The key commodity players, gold and oil, were flat and green, respectively, for the month. Additionally, oil is on the rise due to an announcement that OPEC has reached an agreement on a production freeze. These agreements have been announced before, only to fail to come to fruition. Curiously enough, commodities are up even as the dollar strengthened for the month; generally the two have negative correlation.

Fixed Income

The bond index we follow was flat for the month of September. Bonds received a boost when the Fed chose not to raise interest rates, but gave the gains back upon speculation that the Fed will raise rates soon. Artificially low interest rates set by central banks across the globe have created a rash of uncertainty in fixed income. More disturbing is fact that more than 12% of the world’s government-issued bonds are now negative yielding. According to recent trends and monetary policy, that number will only increase.

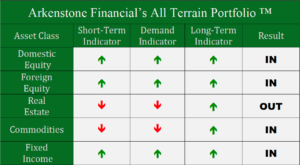

Chart as of market close 10/3/16

Past performance is not indicative of future results. Other asset classes or investment vehicles may be used in client portfolios and client portfolios may not hold all positions of the model at the same time as the model. This chart and its representations are only for use in correlation to the proprietary timing model by Arkenstone Financial, Registered Investment Advisor. Actual client and All Terrain Portfolio(TM) positions may differ from this representation.

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply