When you look at the investment funds from your 401k menu it can be difficult to distinguish one from another. All the data and information associated with these investment choices can even be overwhelming. But even though all these choices look the same, there are definitely some bad options in the group: proprietary funds.

What is a proprietary fund?

A proprietary fund is an investment fund that is created and managed by the 401k provider. To offer an example from a different industry, this is similar to how Home Depot has their own brand of tools and products called HDX. Like Home Depot’s HDX line, a proprietary fund is simply the 401k provider’s version of a fund that their competitors also produce.

How do I know a fund is a proprietary fund?

In many cases, proprietary funds are easy to spot. If the title of the company that services your plan is in the title of the fund on your menu, that’s a proprietary fund. In other cases, you’ll have to do some digging as 401k providers often use subsidiaries to mask the proprietary nature of a fund.

What’s so bad about proprietary funds?

There are two main problems with proprietary funds:

- Conflict of interest.

Often, the salesperson or advisor to your 401k plan may be incentivized to recommend their own products over others. Through commissions and kickbacks, the advisor to the plan may be receiving compensation based on the products the participants choose. - The proprietary funds are more expensive.

Unlike the retail industry where proprietary products are generally cheaper, proprietary investment funds are generally more expensive.

But aren’t all funds pretty much the same?

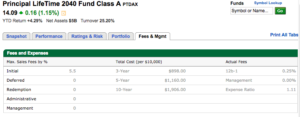

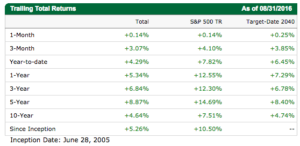

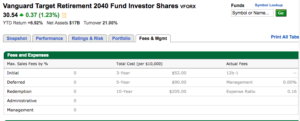

No. The reason isn’t what you’d think, either. Often we see the fees associated with funds vary more than the performance of the funds. Here’s a comparison of two target date 2040 funds that, by nature, have similar investment objectives:

above data courtesy of TD Ameritrade

If you’ve just experienced data overload, here’s the quick summary: If you invested $10,000 ten years ago with the Principal 2040 fund, you would have paid 829% more in fees while earning 23% less in investment returns versus the fees and performance of the Vanguard 2040 fund.

Unfortunately, this is not a hypothetical scenario. We recently found this Principal 2040 fund while analyzing a 401k plan that was serviced by, you guessed it, Principal. Not surprisingly, the Vanguard 2040 fund was not a choice in this particular plan.

How do I avoid proprietary funds?

Avoiding these types of funds starts with your 401k service provider selection. You’ll be hard pressed to find a Wall Street bank or insurance company that doesn’t offer proprietary products in their 401k platform. However, although independent advisors may be harder to find, they often can provide access to service providers that do not offer proprietary products.

Looking for a way to make sure your 401k plan is performing as expected? Send us an email at 401k@arkfi.com or call us at 719-559-1919.

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply