The U.K.’s surprising vote to leave the European Union (popularly known as “Brexit”) offered a brief negative shock to the global financial system. However, this sudden dip in global equities was short lived as almost all losses were recouped by the time June came to a close.

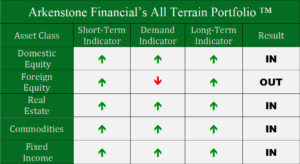

Domestic Equity

What may have been lost in the midst of the media frenzy surrounding Brexit was the decision by the Federal Reserve to not raise interest rates again. Regional Fed presidents were pushing the possibility of a rate hike early in the month, but the June 15th Federal Open Market Committee (FOMC) meeting ended with Fed chair, Janet Yellen, confirming no hike in June. The Fed had good reason not to hike with the U.K. referendum just around the corner. Surprisingly, oddsmakers currently have the chance of a rate cut higher than a rate hike until December of this year. However, the change in the June Fed rationale was stark when compared to previous meeting minutes. Yellen and the Fed were surprisingly transparent in June, indicating that the U.S. and global economic outlook isn’t quite as good as they thought it would be at this point.

The Brexit shock did impact U.S. markets negatively, albeit briefly. Major U.S. indices were off by over 6% in just two days after Brexit, but miraculously recovered all losses in just three more days. However, we can’t help but wonder if there is more long-term fallout to come from Brexit. Overall, the S&P 500 was down less than one percent for the month of June — continuing what has been nearly two years of horizontal movement.

Despite this long-running flat market, there have been a few bright spots in U.S. equities. Particularly the utility and consumer staples sectors of the S&P 500. Utilities are up almost 19% year to date. These two sectors have grown in popularity because of their high yield and defensive nature. With bonds yielding so little, “bond proxies” or equities with high yield, have been a preference of investors.

Foreign Equity

As we have already discussed, the major event of June was Brexit, the United Kingdom’s vote to leave the European Union. Although pollsters had “remain” winning by 3-4% as recently as the night before the vote, the Brits shocked the globe by voting to leave the EU by that same margin. A quick plunge in stocks, globally, ensued. Global stocks ultimately recovered, but the FTSE 100 (the British stock market index) closed June higher than before the referendum, despite the British Pound being reduced substantially. Many financial pundits are saying Brexit fears were overblown and everything is back to normal now. However, the U.K. is the world’s fifth largest economy, by GDP, so this is a major hit financially for the EU. A much greater global concern should be the potential for future fallout. Will other european countries follow suit and leave, destabilizing the EU? Could that potential destabilization affect global markets?

Real Estate

Real estate securities jumped up 6% in June and are now approaching all-time highs. Real estate has become a full fledged bond proxy as the high yield characteristic has investors flocking into it. Perceived as a better option than bonds, due to the higher yield, investors are now using real estate investments as a safe haven as investors reduce risk while searching for yield. It will be fascinating to observe where real estate moves next.

Commodities

Precious metals continue to push commodities higher as the dollar falls. Gold and silver had huge gains in June of 10% and 13%, respectively. Precious metals are typically popular when investment uncertainty is rampant. Brexit definitely fit the bill as gold spiked after the referendum vote results were released. Surprisingly, as global stock markets recovered gold and silver prices kept rising. Since stocks and metals typically trade inversely during times of uncertainty, we wonder if there isn’t more market fluctuation to come as a result of the Brexit vote. Gold is off to its best start to a year since 1980 and has two major tailwinds: global uncertainty and a weakening U.S. dollar.

Fixed Income

The corporate and government bond index we follow was up over 2% in June. Typically bonds are thought of as safe havens for investors and investors move to bonds from stocks when risk levels are perceived to be higher. Despite the current low bond yields (due to low interest rates set by the Fed), investors piled into bonds before, during and after Brexit. Although a Fed interest rate hike would decrease the price of current bonds, investors seem convinced that the next rate hike is not happening anytime soon as prices keep pushing higher and yields move lower. Unfortunately, with continuous mixed signals on interest rate hikes from the Fed, bonds currently have higher than historical risk.

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply