The Federal Reserve left interest rates unchanged while U.S. and global stocks went nowhere. April’s bright stars were gold and oil which were aided by a weakened U.S. dollar.

Domestic Equity

Investors must have used April to catch their breath and re-evaluate the long term outlook of U.S. stocks after stocks rallied from February lows. Registering no gain in April, most U.S. market indices traded in a very tight 2.5-3% window for the entire month. The lack of market motion was for good reason, as corporate earnings reported for the first quarter of 2016 were generally sub par and Gross Domestic Product (GDP) for Q1 reported at around 0.5%. (Incidentally, the Atlanta Federal Reserve has already started downgrading their second quarter GDP predictions.)

Not surprisingly, the Federal Reserve left interest rates unchanged after their April FMOC meeting. By most calculations, the chance of a rate cut (albeit low) was higher than a rate hike by the Fed in April. As of now the month that has the greatest probability of a rate hike this year is December. With no FMOC meeting in May, we’ll have to wait until the end of June for the next decision. In the meantime, there will be plenty of chatter by regional Fed leaders on what the Fed might do.

We mentioned last month that smart money, which is the term coined for private, institutional and hedge fund money flows, had been selling equities for the last 2 1/2 months. This streak of selling has now been extended to 14 weeks, which is the longest streak Bank of America has observed since 2008. It’s worth mentioning that a couple of subsectors of U.S. equities have been positive over the duration of that streak as well..

Foreign Equity

Global stocks saw modest gains for the month. Although up slightly versus U.S. stocks in April, global stocks continue to closely mimic U.S. equities and have done so for the better part of the last two years. Perhaps the massive monetary stimulus announcement of the European Central Bank from last month had something to do with the slight uptick. China, for the second month in a row, stayed out of the headlines, but is due to report some key economic data in early May, so that streak may come to an end. Japan surprised investors when the Bank of Japan decided to pass on increasing its stimulus plan. This surprise had a greater effect on currencies than equities, however. For now, global stocks seem primed to continue following domestic stocks, for better or worse.

Real Estate

April saw interesting price behavior from real estate. Although the sector was slightly down for the month, the way the prices moved throughout April changed and real estate no longer seems hitched to U.S. stock movements. This could be proof that this sector has carved out a niche as a higher yield alternative to bonds and we’ve noticed this in type of investor behavior in other subsections of U.S. equities as well. Investors who are chasing yield, since bonds are so low, are seeking out high dividend paying stocks. If this is the case, it’s a situation that bears monitoring, since real estate is much more volatile than fixed income.

Commodities

Commodities have recently signaled a buy indicator after a strong April. Led by gold and oil, along with a weakened dollar, commodities gained about 9% last month. The downward pressure on the dollar can be explained by the Federal Reserve’s decision not to raise interest rates followed by the Bank of Japan deciding to also stand firm on their current quantitative easing process. The latter was received, globally, as a shock since most anticipated greater measures to be taken by the Bank of Japan. Consequently, the Yen saw its best week since the 2008 crisis against the dollar in the last week of April. Incidentally, oil seems to have decoupled from U.S. stocks in the past month.

Fixed Income

The narrative surrounding bonds hasn’t changed since the beginning of this year. Bonds are currently being plagued by low yields and the fear of a price decrease due to an interest rate hike. This is an atypical risk/reward ratio for bonds and leaves us contemplating whether or not the the upside, albeit minimal, is enough to push investors out of stocks and into bonds.

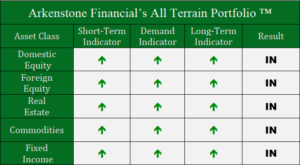

Chart as of 5/2/16

Past performance is not indicative of future results. Other asset classes or investment vehicles may be used in client portfolios and client portfolios may not hold all positions of the model at the same time as the model. This chart and its representations are only for use in correlation to the proprietary timing model by Arkenstone Financial, Registered Investment Advisor. Actual client and All Terrain Portfolio(TM) positions may differ from this representation.

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply