The Federal Reserve Bank finally hiked interest rates and after some brief volatility, markets stabilized to close out the year. That brief volatility blip summarizes 2015 as market sectors were constantly moving, but never really went anywhere. All five major asset classes closed out 2015 in the red.

Domestic Equity

For U.S. stocks, 2015 was the year of the Fed. Although a year’s worth of talk, posture, and minimal action from the Fed amounted to essentially nothing, the Fed was the dominating narrative in the U.S. equity markets. Despite all the chatter around the Fed, domestic equities went nowhere for the year, even ending with a modest loss of about 1%. Although there were a few bumps along the road (including the sharp 10% drop to close out August) this year, equities have shown resilience to major drops and resistance to breakouts. As one might expect in this flat market, a few high performers held this asset class upright as more sectors were negative than positive within the S&P 500 for the year.

2015 could also be considered a year of mergers and acquisitions (M&A’s). Companies like Dow, Dell, Pfizer and Anheuser-Busch led the way with massive mergers. On the surface, this may appear to be a good thing, but an uptick in M&A’s regularly precedes the end of a bull market as companies sacrifice long term growth for short term and appealing fundamentals – also known as financial engineering.

Aside from a brief, three week scare this past fall, U.S. equities spent all of this past year trading in a window that was within 5% of all time highs. Has this bull market grown tired, or are we in for an unprecedented break-out at the tail end of an already historically long bull run? Either way, our model will be closely tracking.

Foreign Equity

Global equities failed to launch in 2015. Many analysts had great expectations for foreign stocks this year and with good reason. Many thought cash would flow out of U.S. stocks and into global stock since the U.S. market seemed exhausted and many central banks around the world were beginning to implement an easy monetary policy similar to the one in the U.S. that saw substantial stock market gains. However, soon after China flatlined midsummer, the global stock outlook lost its rosy glow. Foreign equities have stabilized since, but have gone nowhere since that stabilization. If the past six months are any indication, it appears the entire global market has hitched its cart to the U.S. market’s oxen as the two moved in unison throughout the second half of 2015. A decoupling of the two would make for a healthier investment environment, but only time will tell if that separation is a possibility.

Real Estate

This year was supposed to be much worse in the real estate sector. An interest rate hike was anticipated to cause corporate and residential mortgage rates to skyrocket, resulting in reduced affordability for purchasers. Instead, the rate hike was minimal and occurred at the end of the year, applying little shift to the market. Additionally, a portion of this sector was held up by historically high rent prices. After all was said and done, the real estate sector held up fairly well in 2015, finishing down just 1% for the year.

Commodities

2015 will best be remembered in the commodities market as the year oil tanked (pun intended). This collapse in the oil market began in mid-2014, but kept spiraling downward all of this year. Precious metals followed along to a lesser extent as a strong dollar and low (reported) inflation kept silver and gold undesirable. Although we’ve stated before that this year’s slide is part of a greater, five year trend, we’re hopeful that this cyclical asset class will reverse its momentum for the long-term. The total downward trend in commodities for 2015 was about 30% in the red.

Fixed Income

The bond proxy that we follow, which includes both government and corporate bonds, will finish with an approximate net loss of 2.5% for the year. A year-long analysis of a typical bond ETF reveals a long slow decline, with highs for the year occurring in the first quarter. The anticipation of the Fed rate hike kept eating away at the value of bonds throughout the year and despite that bond prices still remain relatively high, especially considering their low yields. The fixed income outlook is certainly mixed, as some analysts suggest the prices can only go lower as interest rates rise, and others think interest rates are already priced into bonds providing a chance for the bond market to rally. Either way, with low yields, the risk/reward ratio in fixed income won’t be friendly to investors for a while.

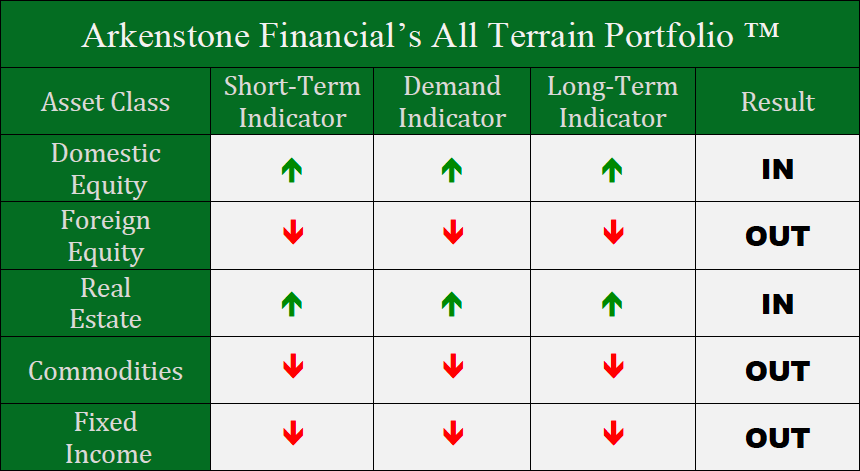

As of Market Close 12/30/15 Past performance is not indicative of future results. Other asset classes or investment vehicles may be used in client portfolios and client portfolios may not hold all positions of the model at the same time as the model. This chart and its representations are only for use in correlation to the proprietary timing model by Arkenstone Financial, Registered Investment Advisor. Actual client and All Terrain Portfolio(TM) positions may differ from this representation

Want to learn more about our investment strategies? Click here to drop us a line.

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply