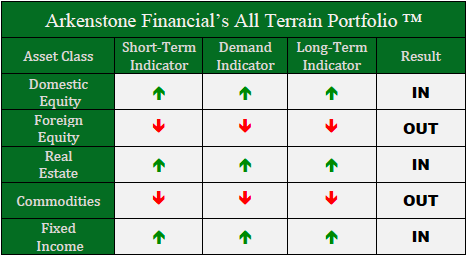

A mostly calm November has kept our indicators steady. All asset classes, aside from commodities, ended the month where they started as markets are collectively waiting to see if the Federal Reserve intends to make good on their December interest rate hike.

Domestic Equity

November saw a slight dip in the U.S. stock market with a modest rally to close out the month exactly where it started. The absence of a Fed meeting and a higher probability of a December interest rate hike seems to have put many investors in wait-and-see mode producing a relatively quiet month. Throughout November, Federal Reserve Board members have been hinting at a December rate hike through various media outlets. By most accounts, the Fed’s desired data thresholds have been met for months now and global uncertainty has slowly dissolved. With the economic data where the Fed wants it, a December rate hike makes sense, in large part because it allows plenty of time for investors to accept that the hike is coming. Additionally, the typically higher consumer and investor sentiment during the holidays makes for a softer landing for the Fed’s plans. With this first hike likely to be small, the biggest unknown will be investor behavior as they react to the first hike in nearly a decade.

Foreign Equity

Global markets followed the same path as domestic equities through November, but were unable to recoup the losses suffered mid-month. As a result, foreign equities remain out of favor with our model. Despite general investor optimism of global markets, and an unprecedented number of countries applying monetary stimulus to their respective economies, the global markets just can’t seem to break through. It’s a bit of a puzzling scenario, but it could simply be the global markets paying close watch to U.S. markets and playing the waiting game. The U.S. is a bit further down the path of their monetary policy experiment than other countries, so we could be considered the guinea pigs, so to speak. If U.S. markets survive the first rate hike, we may see a global market surge in response. Until then, we will need to see greater upward momentum in foreign markets to re-enter this market space.

Real Estate

Real estate had a bit of a hairy ride through this past month and a 5% dip and recovery left November about where it started. Considered an interest rate sensitive environment, real estate will likely remain volatile until 1) a rate hike actually happens and 2) investors decide how they want to respond to the rate hike. At this point, we expect the response of investors to be mixed at best.

Commodities

Commodities continue to be the least desirable investment class available with gold and oil leading the plunge downward. While it’s worth mentioning this downward path is nearing five years now, many have claimed we’ve reached a bottom only for that bottom to be broken through again. If history is an indicator, the long-term outlook for commodities is good, but there’s no telling when this current negative trend will be bucked.

Fixed Income

Bonds followed the same dip and modest rally path of foreign and domestic equities and real estate this past month. If we needed any more evidence that all eyes are on the Fed, it would be that these four, typically uncorrelated asset classes behaved nearly identically over the past month. With minimal growth potential and low yields in fixed income, we think this asset class should be avoided until the market has a chance to digest and react to this impending rate hike.

Chart as of market close 12/1/15 Past performance is not indicative of future results. Other asset classes or investment vehicles may be used in client portfolios and client portfolios may not hold all positions of the model at the same time as the model. This chart and its representations are only for use in correlation to the proprietary timing model by Arkenstone Financial, Registered Investment Advisor. Actual client and All Terrain Portfolio(TM) positions may differ from this representation

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply