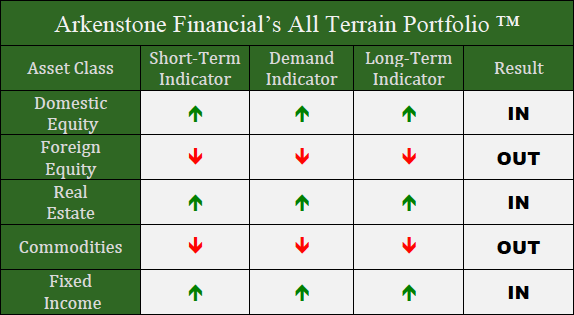

U.S. stocks are once again positive for the year after a strong October pulled equities off of their lows. This quick snapback has our indicators buzzing with optimism, but with the first interest rate hike since 2008 still unresolved, caution is warranted.

Domestic Equity

A lot has changed in the last month with U.S. equities. September closed out near the lows for 2015, only to have an impressive 7.5% rally in October on the heels of more Fed non-action as the Federal Reserve Board once again passed on the opportunity to raise interest rates in October. With no meeting scheduled in November, the next possibility of a hike is now Mid-December. Interestingly, the Fed removed their comments regarding global investment consideration with respect to their rate hike decision from their October minutes. These comments seemed to have rubbed investors the wrong way in September resulting in the first sell off following a non-hike announcement. It was thought these specific comments caused investors to question the Fed’s leadership, as the comments cited a change in rationale. The Fed has since changed its tune back to the U.S economy. Investors and economists now point to a December rate hike as a near certainty. Certainly this is worth monitoring, but with this dog and pony show going on for almost a year now, speculation seems futile.

It may seem silly that interest rates get this much attention when considering the domestic equities outlook, but when S&P 500 goes from the most shorted (or bet against) in years to a full blown rally within the span of a month, we have growing suspicion that Fed action is the primary driver for investor decisions. Nevertheless, our indicators are all green for this sector. It’s an understatement to say that we’ll proceed with caution.

Foreign Equity

Global stocks rallied with U.S. stocks last month, but without the same amount of vigor. Despite the fact that China cut interest rates (again) and the European Central Bank publically declared their commitment to their version of quantitative easing through 2016, global markets seem hesitant. It is possible the recent volatile movements of the U.S. markets have given global investors some reason for pause. With the U.S. nearing an end to its seven-year monetary policy plan and much of the globe in the midst of similar plans, global market participants may be holding out to see how the U.S. experiment ends. For now, our indicators suggest foreign equity isn’t firing on all cylinders.

Real Estate

We mentioned last month that we needed to see more positive growth trends from this asset class with a Fed rate hike looming. We were given just that after the Fed declined to raise rates again. The real estate sector responded with a 6.5% gain in October alone. This rapid increase in value is both good and bad as the impressive short term recovery from the year’s lows creates uncertainty about long term sustainability and growth. We will continue to monitor this sector closely as our model has given us the green light.

Commodities

Another month goes by and commodities continue to go lower. What looked to be bottom in commodities last month was merely a mirage. The U.S. dollar rebounded with domestic stocks to push commodities lower through October. Currently, this asset class is testing long term lows. At some point, this long term downward trend will reverse, setting up for substantial gains in the future. For now, this asset class is undesirable number one.

Fixed Income

Bonds also enjoyed a modest rally during October. What’s concerning about this rally is that it was in concert with equities. This leads us to believe the investment world as a whole is placing too much emphasis on the Federal Reserve’s willingness to increase interest rates. At this point, with so much focus on the Fed, it seems a certainty for shockwaves to move through all investment classes when the Fed does actually move. Our indicators narrowly say it is time to consider allocating into fixed income, but it’s with great caution that we accept these results.

Chart as of 10/30/15 Past performance is not indicative of future results. Other asset classes or investment vehicles may be used in client portfolios and client portfolios may not hold all positions of the model at the same time as the model. This chart and its representations are only for use in correlation to the proprietary timing model by Arkenstone Financial, Registered Investment Advisor. Actual client and All Terrain Portfolio(TM) positions may differ from this representation.

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply