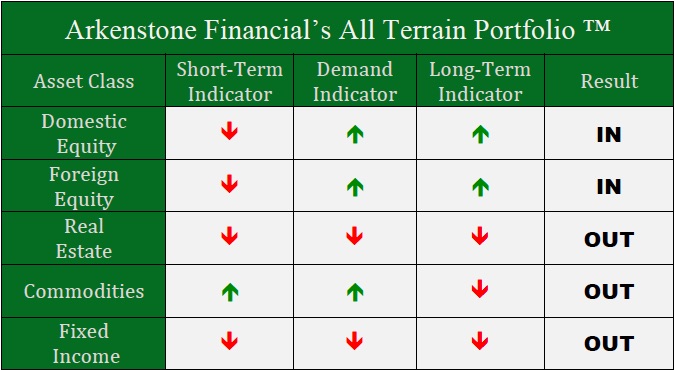

The All Terrain Portfolio™ has detected a mass of uncertainty in the investment world. We’ve now acquired at least one red arrow in each asset class as of the end of June. The most recent sell indicators have been found in domestic and foreign stocks. Below we’ll consider some factors that play into this uncertainty.

Domestic Equity

U.S. stocks continued their sideways movement through most of June with a slight collapse to close out the month. The Federal reserve resumed its dominance in the U.S. stock market conversation and, although it was previously expected, June passed with no interest rate hike from the Fed. Some economists predict a September hike, while others don’t expect a hike until 2016 as the Fed continues to kick the can down the road until stronger growth data is present. The end of month dive appeared to be a ripple effect from broken down Greek negotiations, but that was short lived as the market bounced back once negotiations resumed.

Foreign Equity

A lot has changed in the global stock markets in the last few months. What was once perceived as a safer place for investment has now been riddled with uncertainty and doubt. Greece’s soap opera-like drama has continued up to and past default deadlines. Although it seems every deadline between Euro-area finance ministers and Greece gets extended, the decision for Greece to stay or leave the Euro zone now hinges on a July 5 vote. Last Monday’s market selloff gave a preview of the fear surrounding this decision.

China’s recent stock market collapse has also gone under the radar, thanks to Greece. This recent decline followed an unsustainably wild stock market increase over the last year or so. Huge international implications could follow if this nosedive continues as China the owner of the world’s second largest economy.

Real Estate

Domestic real estate continues it’s downward trend, despite June coming and going with no interest rate hike. Only time will tell if this trend is indicative of investors simply getting out of the way of an investment that is sensitive to interest rates or an initial clue into the broader issue of a changing U.S. economy. Our metrics spotted this decline previously and we will continue to avoid this asset class until positive trends are present.

Commodities

Two steps forward and one step back seems to be recent behavior in commodities. This asset class bottomed out earlier this year, and continues to be held down by a strong dollar. Despite several episodes of short-term breakout, we’ve yet to pick up on a strong long-term positive indicator. If recent performance is any indicator, the long-term trend signal we’ve been waiting for might be right around the corner.

Fixed Income

Fixed income is yet another investment class that seems to be held hostage by looming interest rate hikes. Investors did flock to bonds during last Monday’s market sell off, but generally speaking this asset class has investors nervous. Liquidity issues have recently come to the forefront of the bond conversation as many wonder what will happen to current bonds after an interest rate hike. Those bonds will be less desirable and investors may scramble to sell them off as quickly as they can.

Want more info on the All Terrain Portfolio? Contact us here.

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply