Dave Ramsey’s teen millionaire blog post has recently been making the rounds on social media. Despite the article being over 5 years old, it’s gained an impressive digital second wind and has found its way back onto Facebook and Twitter feeds. The problem: The article is at worst, wrong — and at best, misleading.

The Disclaimer

First of all, I am not a Dave Ramsey hater. I think he’s great. I have read his book, The Total Money Makeover, and apply many of his principles to my own finances. I think it’s an excellent book, especially for young people to read as they enter the workforce. However, that doesn’t mean that we must accept all of his statements as gospel.

The Setup

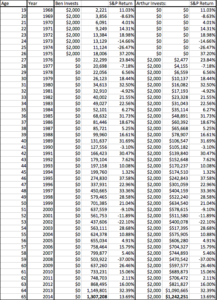

In the blog post How Teens Can Become Millionaires, Ramsey explores the effects of time and compound interest by showing us how Ben, by investing less money earlier in life, will outperform Arthur, who invests more money later on in life. These investments are allowed to grow with a 12% interest rate for 47 years, apparently risk free. Below are the replicated results in chart form:

From this data, you’re lead to believe that it’s relatively simple to become a millionaire if you invest early, and that if you start saving or investing later in life you’ve already missed the boat. Don’t get me wrong — investing early is ideal. But it’s not always practical. Let’s take a look at how these results are misleading and even irresponsible.

The Assumptions

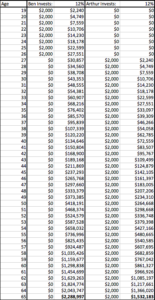

The premise of this study is the root of the problem. The article is founded on the idea of compound interest at a rate of 12%, which means each year the account grows 12% more based on the previous account balance. I’m not sure what the 12% annual interest rate is based on, but there has never been a savings account that yields 12% interest. In 1984, interest rates briefly spiked to the point that a 5-year CD yielded 11.01%, but we haven’t seen CD rates over 6% in close to three decades. Even if we revisit Ben and Arthur and provide each with a still absurdly high (not to mention extinct) 8% interest rate, the results are not so compelling. In fact, it’s clear that Ben, the teen millionaire, actually ends up with less money than Arthur:

Now let’s see what happens if we apply current interest rates for a 5-year CD of 2%. The results are even worse for Ben:

So yes, the original study does display the effects of compound interest, but in a very misleading manner. What Ramsey’s article really showcases is a much simpler theory: that if you have an unrealistically large multiplier (in this case, the interest rate) stretched over a really long time (in this case, more than four decades) you will get a really big result. Since this interest rate scenario does not exist in real life, this article is better characterized as a manipulation of compound interest rather than a demonstration.

Outside of the Vacuum — Annualized is not Actual

At this point, the Dave Ramsey groupies reading this are probably ready to take to Twitter in Ramsey’s defense, because the 12% interest rate he is referring is actually investment returns from mutual funds. Dave claims in The Total Money Makeover that you can find a good mutual fund that will give you a 12% annualized return. Although this claim seems a bit high and is not considerate of commissions and fees paid (which can take up to 30% of your returns) to the fund, I’ll accept it as a possibility.

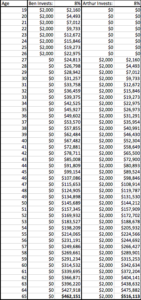

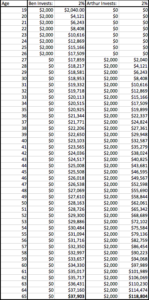

However, an annualized return (or average return over time) is not the same as an actual return. Here’s an example to illuminate this point: Let’s say we invested $100 and let it grow for two years. And let’s also say that this investment yielded an annualized (average) return of 1%. If we ignore actual returns and we interpret this as 1% per year, each year, we would have $101 after the first year and $102.10 after the second. However, if the actual results were a 10% loss the first year and a 12% gain the second year (also an annualized return of 1%) then we’d have $90 after the first year and $100.80 after the second year. The difference? If you apply the annualized growth every year, you assume non-stop positive growth. In reality, due to factors like risk, investments may actually have negative years, which sets growth back. Not convinced? Here’s the same Ben and Arthur chart applied to the last 47 years of the S&P 500’s growth (including dividends), which is 11.5% annualized.

The results are nothing to scoff at, but not nearly as sensational as the original study. In fact, Ben ended up with almost a million dollars less than he had in the original. On the flip side, with actual data, Arthur did underperform, but only slightly. Additionally, in order to set expectations appropriately, based on the fact that this data ends at record highs for the S&P 500, Ben and Arthur effectively timed the market perfectly – which is essentially impossible. So if we looked at another 47 year data set it is likely the results would be lower. And don’t forget that taxes and investment fees are not considered in this example, which will also ultimately bring the results down substantially.

The Takeaways

- Ramsey is right: the earlier you invest, the better off you are. But you must consider your opportunity cost, too.

- Ramsey is also wrong: you are not doomed if you start saving later in life and you can catch up by saving more.

- There is no such thing as a 12% interest rate, and it’s important to understand the premise of data sets when you consider their results.

Interested in getting started with saving or investing? Contact us today and we’d be glad to help!

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

I do see your point. The CD chart was irrelevant to mention because a lot less people are looking to depend on CD’s for retirement anymore. Dave simply explains how time is money. By entering the workforce early at the age of 19 and investing can earn you more money for retirement than a college graduate investing 6 times that same amount. I do agree with you about the fees that aren’t being factored in, but numbers don’t lie my friend.

Thanks for your feedback. I agree, starting early is ideal, if possible. I also agree with Dave Ramsey’s point that time is money. However, this leads me to my issue with his unrealistic premise – 12% compound interest. The CD charts were included because the mathematics of compound interest falsely represents the behavior of stocks and bonds, but accurately represent how a CD would perform. However, since 12% interest rates have never existed in CDs I used both 8% and 2% returning CDs to highlight the stark difference between Dave’s theory and current reality. No, numbers do not lie, but an unrealistic premise will produce unrealistic results.

The Arkenstone Team

Hi, I think you are missing Dave’s point because this chart has been taken out of the original context, which is the first lesson of the original 13 lesson FPU on the importance of saving and the impact of starting early. And if you are a fan, you know in his early years he conflated saving and investing under the whole umbrella of “putting aside money”.

Hi Kristy,

Thanks for your feedback! We are huge proponents of starting early with your savings and the value of saving early, both of which we agree are demonstrated in Ramsey’s chart, and certainly don’t consider that the point in question. The problem is that this demonstration and the original chart produced by Ramsey are completely overblown – and not only is it mathematically wrong, it is also unrealistic. Because the chart so inaccurately represents how investments grow, it trivializes the amount of hard work and discipline (and money!) it takes to retire a millionaire. Not to mention, $2,000 in 1969 (47 years ago) is equivalent to $13,079.40 in today’s dollars (inflation).

To put the conversation in modern context, this example requires about $100,000 saved by the age of 26, which is unfortunately not a likely reality for many young people today. But, the largest problems with Ramsey’s demonstration is that even it it was, the money would not grow at the rate he describes.

We consider this an illuminating example we can draw several lessons from. First, that starting young isn’t the only essential step in retiring comfortably. And second, that all data needs to be scrutinized before it’s fully accepted.

Thanks again for engaging with this article!

Inflation link: https://data.bls.gov/cgi-bin/cpicalc.pl?cost1=2000&year1=1969&year2=2016

Shayne… I realize that you may not ever get this message as the article is several years old. But if you do get it, I think it is important to point out that Dave Ramsey is not talking about SAVING money in a bank, or even putting it in a Certificate of Depression… but rather Investing into a ROTH and or 401K if you should be so lucky at a young age. I was not introduced to Dave until I was almost 40… I am not a millionaire, had I been introduced to Dave at 18… I most certainly would be, at least 3 times over. Because I realize you, or anyone for that matter may never see this… That is all the time I am putting into it.

Hi Paul,

What you’re describing is part of our point. The original Dave article uses an investment that grows 12% every year which can only be illustrated using compound interest. The best example of an investment vehicle that grows that way is a risk free asset like a certificate of deposit. You’re correct, Dave is not referring to CDs, but likely referring to risky investments like stocks. Risk assets do not grow every year, sometimes they lose value. Thus, compound interest based on average returns is not an appropriate mathematical approach to projecting risk asset growth. If you are going to attempt to use compound interest to project risk asset growth, use annualized returns, not average, to account for down years. Annualized returns (over the last 20 years in the S&P 500) for stocks is closer to 4.5%. Thanks for reading.

You should have done a little more research on what he teaches before you wrote this article. He never once says a “savings account” can yield 12%. Plus, he teaches to never invest in any CD. He teaches the teens to invest in mutual funds. From 1923 to 2016, the average annual return on mutual funds is 12.25%. He doesn’t take into account the fees for mutual funds but that’s way less than the return. I teach a Career Preparedness class for High School students and we use the Dave Ramsey curriculum. I do teach my students not to plan their retirement based on a 12% annual return but it’s not completely unrealistic for him to use what mutual funds have average for 85 years. Dave Ramsey isn’t perfect in what he teaches but he’s the best out there.

For more info on exactly what he teaches, go to http://www.daveramsey.com/blog/the-12-reality

Ironic that it seems you didn’t read his article before posting your comment because he addresses that Dave is not saying CD’s or Savings but Mutual Funds.

The article was well written and had excellent points. One of which was that “averaging” 12% doesn’t mean you get 12% annually. If you are faced with down years early then you are severely retarded in this growth.

Dave always teaches to invest in growth stock mutual funds, and the article didn’t say to invest in CDs. You can find growth stock mutual funds that have an S&P 500 rating averaging around %12 over the long haul.

Thanks for your comment, Hunter. Dave’s original article uses incorrect mathematics to project the growth of a mutual fund. The math he uses (compound interest) is only accurately used to project future growth of items with guaranteed returns, such as CD’s, which is why we used that example in our article.

The last example we provided uses actual historical returns from the S&P 500, which is very near that 12% (annualized) rate of return that Dave speaks of. This more accurately displays the hypothetical investment returns of Ben and Arthur than Dave’s original point. Another point of concern with the example outlined by Ramsey is that the 12% annual growth standard he refers to has become increasingly more difficult to realize in the past 15-20 years, especially if the investments in question contain no diversification.

He also teaches diversification to teens. I’m also a math teacher and you are correct in that mutual funds don’t rise at a constant rate like savings investigation. But he’s also taking an average rate. Your math is more accurate but the idea of “early investments pay off” is still true. In fact, if you take out “the lost decade” of the recession (2000-2009) 12% is actually low. You can’t get a 50 year CD anyway. But, he also teaches them to find a good financial planner to diversify and use various types of mutual funds (foreign, etc).

Actually taking the Financial Peace University course, not just reading the book, you will see that he averages 12% on mutual funds, because he gets 18% on several of them!

Dave used 12% because it’s was (at the time it was written) the average rate of return of the stock market for OVER the last 70 years (I think). It’s now about 11.5. If you pick shorter intervals (as some ppl have done) you are going to get a different set of results.

Again ..it’s average return…right now the stock market is going up up up….

and anyone who is smart knows… a correction is coming soon.

I too am a mathematician and a financial analyst. I am well-read on several well-known authors as it pertains to wealth-building and personal finance. While I don’t agree 100% with Dave Ramsey’s chart or with 100% of his other teachings, there are some key elements on which he is absolutely correct.

The purpose of his chart is to show individuals the importance of beginning to invest for retirement as early as possible. Young people often think that retirement is not something they will need to start thinking about until they’re much older. This chart does not say that they can’t do so with success. It says that the longer you wait, the more you will need to invest to reach the goals your anticipated retirement lifestyle will require.

Based on your models, the one that most accurately depicts the flaw in Ramsey’s chart is your final one. His teachings focus on diversification and on growth stock mutual funds. As it stands, though, the only point that I see your chart making is that his final balances are exaggerated. I believe the point is still the same, the first fictitious person invests a total of $16,000 and stops investing entirely at age 26 (as if anyone would do such a thing, especially a person who had invested at all by age 26). The other has invested $78,000 for the remainder of his working life. In the end, the latter never catches up.

It’s not about telling kids to invest until they’re 26 and to stop. It’s about telling people (especially young people) that the time to begin investing is always now. It’s also not about telling people who are above the age of 26 that it’s too late to start. Just the opposite! Start your savings immediately, no matter what your age may be. In other words… time IS money.

Also even if the chart is half wrong it’s more than not investing at all, plus you aren’t going to get that rate of return from social insecurity that the government so well manages. Wish I started at 20 wouldn’t have to play catch up now.

Hi Shayne

This is one of the best reviews of Daves’s post I have read. Dave does a decent enough job helping people get out of debt. However, his advice is not without faults.

Assuming 12% returns is a potentially dangerous. There is a lot of reasons to believe economic growth may be lower in the next several decades. (ageing population, ballooning debt, lack of new frontiers)

It would be prudent to save early, and assume a significantly lower rate. If the market overperforms, great retire sooner or do more in retirement.

Should the market underperform you nay not realize it until it’s too late, and the cost to play catch up could be insurmountable.

Thanks, Michael!

You made a claim that “Arthur did underperform, but only slightly” over the 47 year S&P 500 history. I think you’re way off here, Arthur underperformed GREATLY. Remember, Ben only put $2000 away for 8 years, or $16,000 and attained $1,307,208. That’s 81.7 times the initial investment(s). Arthur put away $78,000 and ended up with $1,242251. That’s close until you realize his growth was only 15.9 times the amount invested. Had he put that amount away in 8 years along with Ben he’d have $6,372,600. Now it no longer seems like he underperformed “slightly”, doesn’t it?

Now should Arthur have just abandoned the idea of saving since he didn’t do it before 25? No. He rightly saved a lot and kept it up. Would the differences be as extreme with a 10% rate of return? Of course not. Do these rates help cement the idea in kids that they should save early? Absolutely.

Thank you for your comment. The quote you are referring to is regarding Arthur’s total return measured against Ben’s, so our statement is factually accurate. You are measuring return on investment for the individual, which by your numbers, show a great disparity. However your disparity is large because of the void not accounted for by inflation. We intentionally left this out of our comparison because our primary focus was to show that, at a basic level, the math and context in Dave’s original article was wrong. You’ll find when you factor in inflation and consider real returns, your return on investment numbers are not as compelling. When adjusted for inflation, Ben contributed about $92k in today’s dollars, versus $144k by Arthur. So the inflation-adjusted return on investment for Ben and Arthur are 14.16 and 8.61, respectively. This difference can be attributed to the head start that Ben had over Arthur, which reinforces the idea that saving earlier is better, something we all agree on. If we take a trip back to 1968 for more context, when the 19-year-old Ben started contributing, the minimum wage was $1.60. It would be reasonable to assume he would be making something near that wage. However, contributing $2,000 per year would be over half of his annual wages, which would be an unreasonable premise. To put that in today’s terms that would have a 19 year old contributing about $14,000 per year – a highly unlikely proposition.

This brings us back to our original point – it’s important to use proper math and context when trying to help and teach young people how to save. We’re always happy to have a more in-depth conversation about the data above and our investment strategy as a whole – please shoot us an email if you would like to discuss.

Sources:

https://www.bls.gov/data/inflation_calculator.htm

https://www.dol.gov/whd/state/stateMinWageHis.htm

I first saw this chart about 25 years ago. At that time the 12% was not outrageous many advisors were promoting 10 to 12 percent returns.

I do believe that the intent was just to show the power of compounding and how much more that works for you with more time, starting earlier in life. It is meant to be an eye opener.

I’m so glad to see you have been out there for 30 years convincing the average Joe and Jane that they too can do it and to get off their duff and start.

Thanks Dave!

Oh this is not Dave’s site it’s someone who know better.

Hi Len,

You’ll find at the beginning of the article we give Dave and his approach praise and even link to his book.

We wrote the article to call out the mathematical errors and assumptions of the original Ramsey article. We did that not cast a shadow on Dave Ramsey, but to help his followers set their expectations more appropriately.

If you’d like to discuss the flawed mathematics and how the Ramsey article trivializes the challenges of investing in risk assets and creating great wealth, please feel free to contact me via email or phone at our Colorado office. You can find that contact information on this website.

WOW! I really was looking to understand this factual representation of Ben and Arther, and this article explains it beautifully.

To all those die hard fans of Dave and coming after this article, be realistic!

Don’t forget that there are several big companies which were at all time high are no where near that figure now, and even if they crossed their all time high it took them a very long time, look for Microsoft or CITI group as an Example.

Also, what I’ve personally observed is that every 4 year there is a huge shift change, also not to forget that if Arther were to keep investing he might find some very good stocks IDK may be cryptocurrencies. While Ben is waiting, some of his companies might go bankrupt.

In a real world, Ben will lose big time.

Again, I’m talking real world!

Imagine If Warren Buffet had stopped after 30 or 40.

Thank you!

1. The 12% is from mutual funds. And 12% is not hard to get. Fidelity, for example, has many mutual funds that go back to the 80’s that have a lifetime rate of 15-16% so getting 12 is not hard.

2. Maybe I missed it but nowhere does he suggest the other guy is doomed for waiting.