Every company has it’s own unique set of goals, plans and needs. Here are the top three retirement plans and key insights into why they’re a good idea and which one is best for your business.

Why a retirement plan is good for your company

Having a company sponsored retirement plan has two major benefits. The first reason is the ability to attract and retain talented or skilled employees in your industry. Job turnover can be very frustrating as a company leader and detrimental to the growth of your company. A retirement plan could an incentive to lure in top talent as well as a reason for them to say with you.

The second benefit of offering a company sponsored retirement plan is to ease your company’s tax bill. Since your company tax bill is calculated on the funds left over after you pay expenses, you can lower that leftover fund through retirement contributions, thus lowering your tax bill. Some retirement plans even qualify your company for tax credits.

Why a retirement plan is good for your employees

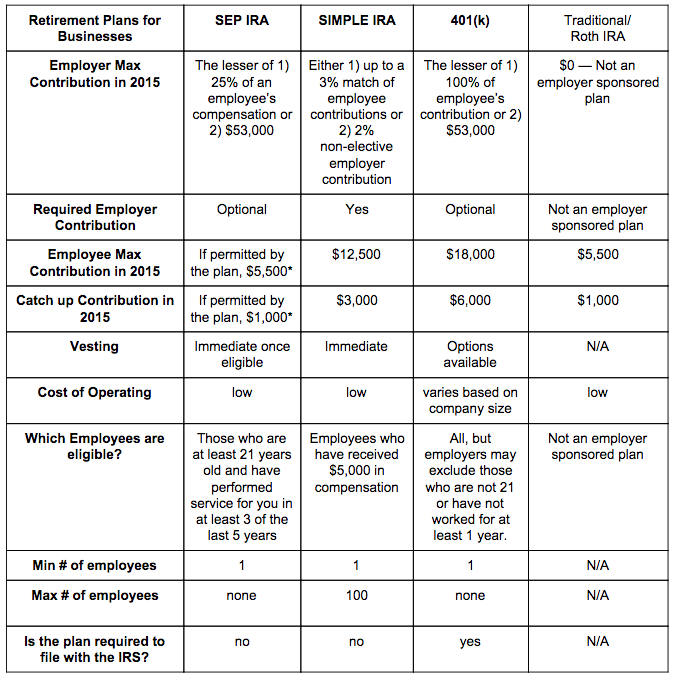

The employee benefit is extremely straight forward. Not only does their company pay them to save for retirement, but maximum contributions are substantially higher in employer sponsored plans than in individual retirement accounts. Meaning, employees can save a lot more through a company plan than on their own. These same perks typically apply to business owners as well.

Why a SEP IRA plan could be good for your business

A SEP IRA is essentially a profit-sharing plan, which means that the success of your business is split among your employees and provides them with additional motivation to contribute. Unlike a bonus, this money is received untaxed into your employees retirement account. The setup and maintenance of a SEP plan is relatively easy and low in costs. Another nice thing about a SEP, especially for businesses which are cyclical in nature, is that you are not locked into the same amount each year. You can give out a higher percent in good years and trim back in the less prosperous years. You must, however, include all eligible employees.

Why a SIMPLE IRA plan could be good for your business

A SIMPLE IRA plan is similarly inexpensive and easy to set up and run like a SEP plan, but the execution of the plan is more comparable to the familiar 401(k) plan. However, unlike a 401(k) plan, a SIMPLE gives you two options to contribute to your employee’s retirement. You can either match an employee’s contribution or choose to give a fixed percentage of each eligible employee’s pay. If your company’s cash flow is more predictable, this could be a better solution for your employees than a SEP plan.

Why a 401(k) plan could be good for your business

A 401(k) plan, like a SIMPLE, allows the employer to match an employee’s contributions, although the company match is not limited to 3%. Unlike a SIMPLE, these plans typically have vesting options that encourage long-term commitment from employees. Although 401(k)s are typically associated with large companies, they can be appropriate for smaller businesses. Generally speaking we advise companies with 10 to 15 or more full time employees to consider a 401(k) plan when determining the appropriate company sponsored retirement plan. It is true that start up costs can discourage smaller businesses from starting a 401(k), but management fees have been coming down in recent years, and now Registered Investment Advisory firms are offering this service and can typically perform the service at a much lower cost than banks and insurance companies.

Here’s quick reference guide of all the previously referenced company retirement plans along with traditional/Roth IRA information for comparison:

*The amount of the regular IRA contribution that you can deduct on your income tax return may be reduced or eliminated due to your participation in the SEP plan.

*The amount of the regular IRA contribution that you can deduct on your income tax return may be reduced or eliminated due to your participation in the SEP plan.

Curious to know which plan is right for your business? Give us a call at (719) 559-1919 or email us at getstarted@arkfi.com and we’d be glad to help you find the right solution for your business.

photo credit: BC Venture Capital Programs

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply