Target date funds have grown in popularity over the last five years because of their relatively easy-to-understand investment objective. These funds have become the go-to investment fund in most company 401(k)s and often are the default fund selected for you when you’re auto-enrolled into your 401(k) plan at work. Despite this relatively clear investment objective (you plan on retiring near the date on your fund), it seems every investment company has their own version of it. So they must be all the same, right? It turns out not all target date funds are created equal.

What is a target date fund?

A target date fund is an actively managed mutual fund that gradually reduces the risk of its investments as retirement approaches. For example a target date fund dated 2045 might have a 90/10 stock/bond ratio, which has higher risk but is appropriate since retirement timeline is 30 years from now. The fund manager will gradually change that investment ratio as the retirement target date approaches to a lower stock/higher bond ratio to reduce risk as the retirement date draws closer. The best part is that you don’t have to do any work, you just keep contributing and let the fund manager take care of the rest.

Are all target date funds the same?

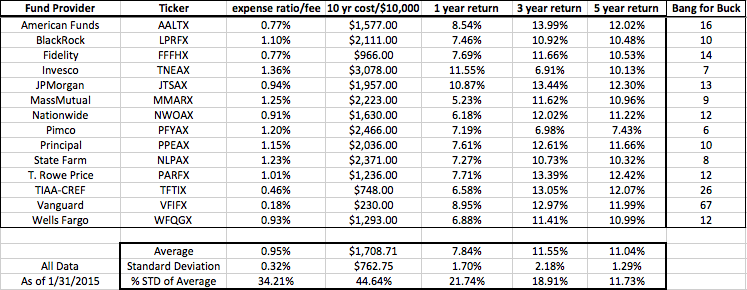

In short, the answer is no. Here’s how we arrived at that conclusion: we gathered a list of the top 14 target date funds from U.S. News and World Report. Then, we looked at funds with a target retirement of the years 2046-2050 that had five years of performance data, and when a company offered multiple funds we chose the fund that held the most assets. Here is the data set we used in our study:

Expense ratio can be summarized as annual fees. Bang for buck is our value metric calculated by dividing the 5 year return by expense ratio.. All performance data is annualized after expenses are calculated. All fee, cost, and performance data courtesy TD Ameritrade.

Expense ratio can be summarized as annual fees. Bang for buck is our value metric calculated by dividing the 5 year return by expense ratio.. All performance data is annualized after expenses are calculated. All fee, cost, and performance data courtesy TD Ameritrade.

Winners and Losers

Vanguard and TIAA-CREF are the clear cut winners, and both have better than average returns over five years while charging substantially less than their competition. Pimco and Invesco are our losers in this study because their performance just doesn’t justify their higher than average fees.

Overall Conclusions

The most interesting part of this study is that fees and costs fluctuate (according to our standard deviation results) more than the actual performance of the funds. This means that while performance of these funds tend group tighter and tighter as time goes on, the ongoing expenses continue to be widespread. These results beg the question: do you get what you pay for with target date funds? No. In fact, we found the opposite to be true over time.

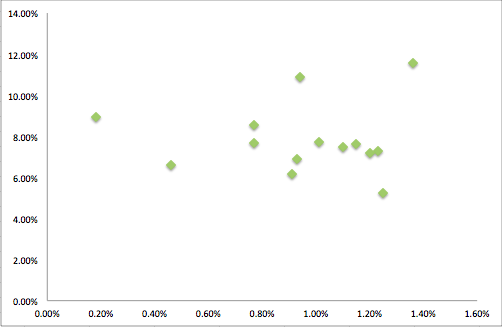

Expenses vs. Performance over One Year. Correlation: 0.003

Expenses vs. Performance over One Year. Correlation: 0.003

Above we’ve plotted our funds with respect to fees and performance over one year. The correlation between the two variables is almost a perfect zero which means there is absolutely no prediction of performance based on fees. However, as time goes on, performance of these funds tend to become more similar, since they have similar investment objectives, but high fees begin to eat away at returns.

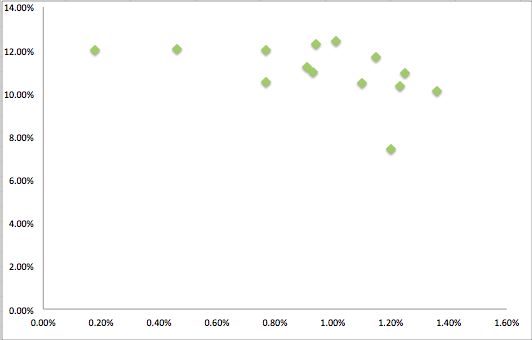

Expenses vs. Performance over Five Years. Correlation: -0.498

Expenses vs. Performance over Five Years. Correlation: -0.498

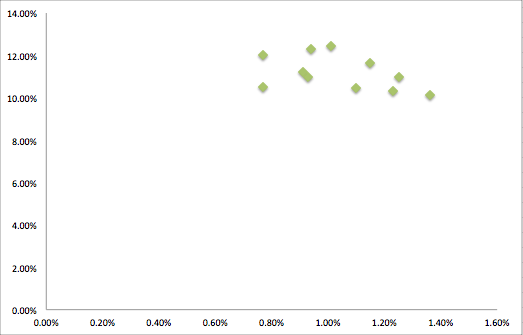

When we look at the relationship of expenses against five year performance (above), we observe a slight downward trend in the data. This trend yields a -0.498 correlation result, which, in statistics speak, is a moderate, negative relationship. For our purposes, it means there is evidence that the MORE you pay in expenses, the LOWER performance you will get in return. We would expect this correlation to only become more defined over time because of the way investment compounding works. Even when we remove the three extreme data points (below) from our study (Vanguard, TIAA-CREF, and Pimco) you get a nearly identical -0.453 relationship.

Expenses vs. Performance over Five Years excluding outliers. Correlation: -0.453

Expenses vs. Performance over Five Years excluding outliers. Correlation: -0.453

So what can you do about it?

As we’ve mentioned before, the more active you are in your 401(k), the more likely you are to avoid being enrolled into a fund with high fees. In most 401(k) plans there are alternative investments to target date funds. You could go through your choices with your advisor in the hopes of finding a cheaper, yet still appropriate fund. Unfortunately, in some cases you are trapped by the choices that your 401(k) plan administrator (the company that runs the investment side of the plan) gives you, and those choices are often proprietary funds with high fees. In some rarer cases, your plan provider can provide you with multiple low cost, non-proprietary alternatives.

Would like us to uncover the fees in your target date fund? Give us a call at (719) 559-1919 or email us at 401k@arkfi.com.

photo credit: Sebastien Wiertz

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply