How to Smell the Smoke

In parts one and two of our 401(k) series we covered why you might not be aware of the high fees being charged to your 401(k) and what high fees can do to your 401(k) account over time. Our third and final entry in this series will help you discover if your plan is plagued by high fees and what you can do about it. So, let’s dive into this with a simple quiz.

What You Can’t See When you Pick Your Fund

Which of the following funds would you pick? Company A lists the Principal LifeTime 2040 mutual fund as their second most popular investment vehicle for their company 401(k). Here are the fees and performance associated with the fund, courtesy of TD Ameritrade:

According to the above data, the Principal LifeTime 2040 Fund will require $1,988 in fees and yields a return of about 5.9% over 10 years.

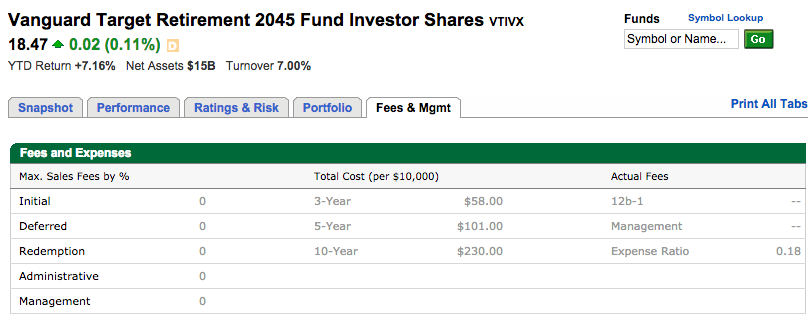

Company B has a nearly identical mutual fund, Vanguard Target Retirement 2045, as their second most popular investment vehicle. Here are the fees and performance associated with this fund:

The above Vanguard Target Retirement 2045 fund yields a 6.8% return, but only demands $230 in fees over a 10 year period.

In an ideal situation, you’re going to choose the fund offered from the Company B 401(k) plan because it costs much less and outperforms the similar fund from the Company A 401(k) plan. Unfortunately, employees can’t choose between funds offered by different 401(k) providers. You can only choose from the funds offered by your 401(k) provider. So how does one fund cost 764% more (over ten years) and return less than another fund despite a similar objective? It depends on who’s offering it.

How to Identify High Fees

Unfortunately, when you’re enrolled – or worse auto-enrolled – into your company 401(k) you don’t see the pictures we have above. And your 401(k) provider likes it that way. To help combat this lack of clarity we will walk you through the process of identifying high fees as an employee might see them through enrollment.

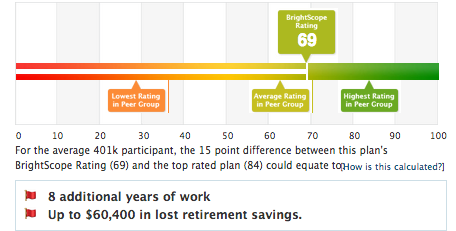

We’ll start from the beginning and look at how we got to the comparison above. We will begin by using a Brightscope evaluation on Company A’s and Company B’s respective 401(k) plans. Brightscope is an independent website that ranks company 401(k) plans using public information (tax records) for free.

Company A

Company A  Company B

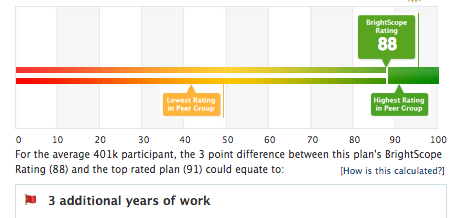

Company B

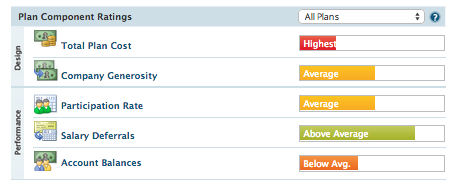

Clearly, Company B has the desired 401(k) plan according to Brightscope, but how do they arrive at these numbers? Let’s look at the breakdown of Company A’s plan characteristics:

Notice the red, high fees rating, and it’s byproduct, below average account balances. Everything else about this plan is either average or above.

Here is the Company B breakdown:

To start, the company generosity is much greater with Company B, but what really sticks out is the stark contrast in fees between the companies – something that should come as no surprise after our introductory comparison. Let’s dig deeper to see what makes one company’s fees red versus green.

What the Employee Sees

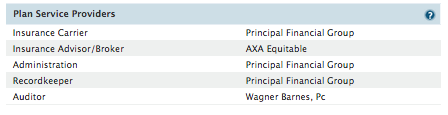

Below are Company A’s 401(k) top holdings and plan administrator’s information. Something that, as an employee, you should have access to whenever you wish, at least during renewal periods or during initial enrollment into the plan.

Company A’s plan administrator, The Principal, is an insurance company, and the plan’s largest holdings are proprietary funds from the insurance company (you should recognize the the second fund from the comparison above). This means that The Principal, whether unintentionally or not, is collecting a large additional fee to manage their own fund, on top of the fee they charge to manage the entire company 401(k) plan. This is exactly the type of high, double layered fee concept we spoke of in part two of this series. So let’s see how Company B is different by examining their information.

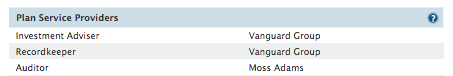

At first glance, this may seem just like Company A, but there is one subtle difference. The plan administrator is an investment advisor, not an insurance company. And although the top holdings in this 401(k) plan are proprietary funds, that’s a little deceiving because Vanguard funds are actually cheap (see above, if you’ve forgotten). In fact, if your company chose an independent Registered Investment Advisory Firm to manage your company 401(k), they would probably have you invested in Vanguard funds or similarly inexpensive ETFs. Again, Vanguard is not an insurance company so they don’t have to charge high fees to cover the high costs associated with doing business in the insurance industry. And, by the way, Company B is Google, a progressive, forward-thinking and people-centered company.

The Questions You Need Answers to

To determine if your 401(k) is being gouged by high fees there are two questions you need to answer.

1) Is your 401(k) provider an insurance company or does it have branches that are associated with insurance?

2) Is your 401(k) provider’s company name part of the fund they have you invested in?

If you answered yes to both of those questions, then your 401(k) is likely being subjected to unnecessary, high fees, and you will have substantially less in your 401(k) account when you retire, or you’ll work longer than you should to make up for it.

What You, the Employee, Can Do About It

This is the frustrating part for employees. You cannot simply go out and choose who will manage your company 401(k). Typically, that choice falls on one or two people at your company. Your company human resource officer or chief financial officer is normally charged with making this decision (if you’re not sure who it is, ask your secretary). More times than not, these employees are extremely busy and can’t always put in the painstaking, necessary due diligence to sort through all the details of each 401(k) offering. Not to mention, transparency has been an issue for 401(k) plan providers and it’s quite possible they are not clearly disclosing all fees to your HR or CFO. Or your HR or CFO is simply not aware of other choices in the 401(k) space. So the best you can do to make change is to talk to your HR or CFO. Ask them about the current provider. Get the answers to the above to questions. Send them a link to this article. You can even ask us to call them. The point is, do something, so that there more awareness about this 401(k) crisis. It might not seem like a crisis now, but it could be when you want to retire.

Beyond the Fees, Why the Switch Is Worth It.

Registered Investment Advisory Firms must, by law, do what is best for the client at all times. Insurance companies do not, except when they act as the fiduciary to a 401(k) plan – when they advise you on your 401(k) account. Wouldn’t you rather have someone looking out for you all the time, and not just some of the time?

Want to know if you’re being subjected to high fees in your company 401(k) plan? Call us at (719) 559-1919 or email us at 401k@arkfi.com and we will give you a free company 401(k) analysis from a quick, five minute survey.

photo by taxcredits.net

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply