Fees, 401(k)s, and the Mathematical Power of Compounding

We made a bold statement in part one of this series: you should care who manages your 401(k). Simply put, your 401(k) plan administrator could be costing you thousands of dollars and causing you to work longer than you should have to. In this segment of our series, we will show you the math behind that statement.

The Premise

In part one we talked about the current high fees employees could be facing with their company 401(k) plan, along with the lack of alternative options in this investment space. We mentioned that only recently have Registered Investment Advisory (RIAs) firms began to offer this service to compete with big insurance, brokerage and mutual fund companies. Additionally, these RIAs can manage the plans for a lower fee. We’ll show you what that difference in fees looks like in dollars below.

Company A will represent an insurance company who charges a 1.5% fee for managing the fund. This number is from the low end of a fee range given by Plan Advisor. Company B is an RIA who is able to manage your 401(k) for a 1% fee, which includes all expenses. The rest of this test will remain the same. To keep this test simple, we will explore the effects of fees on a 401(k) account that starts with $25,000 and has an annual return of 5% for the next 35 years.

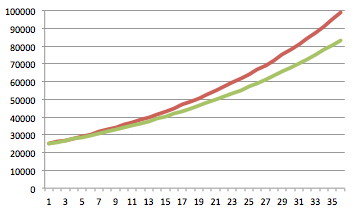

The Results: The First Layer of Fees

The chart below shows how your money would grow over 35 years. The account with Company A is green and account with Company B is red. Company A ends up at about $83,000, whereas Company B accumulates almost $99,000. So that additional one-half percent of fees nets you about 16% less in your account.

Sound unbelievable? The Department of Labor ran a similar test and concluded that an additional 1% in fees would leave you with 28% less in your 401(k) account after 35 years.

Hidden Agenda

As you may have noticed by the title of the previous section, we were only looking at one layer of fees and, unfortunately, many insurance and mutual fund companies have a second layer of hidden fees. These are the fees that has the Department of Labor very interested in the transparency of 401(k) plan administer records.

The second layer is due to self-dealing in 401(k) accounts by plan administrators. This self-dealing is exactly what got Fidelity sued by it’s own employees. Here’s an example: Company A charges you 1.5% to manage your 401(k), but offers a variety of proprietary funds (Company A also owns the funds) for you to choose from. You pick a fund that looks appropriate, perhaps without realizing that the fund has its own additional management fee. This is the second layer of fees.

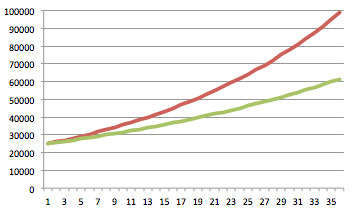

The Results: The Second Layer of Fees

A mutual fund is a typical proprietary fund offered by 401(k) plan administrators that carries an additional fee for active management. Investopedia states that typically mutual fund fees run from 1.3% to 1.5%. However, in this example when we run the results of this second layer of fees, we will be generous and only add another .9% to Company A’s 1.5% fee. This results in a total fee of 2.4% for Company A. Because Company B does not offer proprietary funds (because they don’t own any) their fee stays at 1%.

As you might have guessed, the difference in returns are now even more drastic. Company A now only earns you about $61,000 versus the previously stated $99,000 from Company B. Yikes, you’re now looking at about 38% less in your account if Company A is managing your portfolio. How many more years will that cause you to work?

What’s Next: How to Smell the Smoke

Now that we have your attention, you’re probably wondering if your 401(k) account is being plagued by high fees. But what you can do about it? We will answer this question and more in the final section of this three-part series next week.

Photo by Flickr

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply