It’s hard to stop trying to keep up with the Joneses. In fact, according to a recent article by Life Hacker, trying to compete with the people around you is one of the most common mistakes of people in their 30s. The Joneses are everywhere you go, although they may go by a different last name. Whether they’re a friend, a family member or the neighbor two houses down, how do you combat the Jones? Here are a few thoughts to consider:

1. Adjust Your Perspective on Real Wealth

Try reading The Millionaire Next Door, by Tom Stanley, to help normalize your perspective on other people’s financial situations. Stanley explains that wealth is not pretty cars and big houses. More often than not, these items showcase an ability to spend, not an ability to accumulate wealth. For example, his studies conclude that German luxury cars belong to individuals with more debt than any other subgroup of automobiles. So think again when you assume every BMW driver is “loaded.”

2. Don’t Try to Compete

The cards are stacked against you. There are a lot more Joneses than there of you, so you can’t possibly compete with all of them. Instead, narrow your focus to what your family’s goals are. Meeting your family goals will up your contentment and act as a reminder that you can achieve what really matters to you. Meeting someone else’s goals will not.

3. Try to Educate

Engage the Joneses in a conversation about the pros and cons of frivolous spending. Many of you might be saying to yourself, “Their money is their business.” This is true, but the line begins to blur when their spending begins to affect yours. Even if your thoughts on spending fall on deaf ears, you’ll at least reinforce your convictions on proper spending.

4. Show, Don’t Tell

Buy the sports car! Just buy one you can afford, or save for it and buy it used. I like cars, but really whats the difference between this Corvette and this one? To me it looks like about three years, 7,000 miles and $20,000 more. Sure it’s a newer model, but won’t there always be a new model? Show your neighbors (give them a ride) that your three year old Corvette is just as fast as the new one.

5. Don’t Reinforce

Going googly-eyed over a neighbors shiny new Harley that only costs him $8 a day reinforces the Jones’ behavior on two levels. First, it’s positive reinforcement for making the purchase, thus perpetuating the cycle of spending. Second, it challenges your own self-discipline and spending control. Don’t worry, eventually you’ll get the Harley, it just won’t come with payments riding in the sidecar.

6. Stop Living with Them

Chances are if you are looking to buy a home you’ll eventually be confronted with a choice between the dream home that would stretch your financial limits and the affordable home that has everything you needed. The Joneses always pick the dream home. Eliminate temptation by picking the affordable home so you don’t have to live next door to the Joneses.

7. Create a Healthy Financial Environment

To be clear, you are definitely allowed to spend money while not keeping up with the Joneses. Just do it in a way that promotes responsible spending for your friends and family to see. Taking vacations, remodeling the kitchen and buying the new couch are things you should do. However, it’s equally important for friends and family to know that you took the vacation because travel is important to you. Or that you remodeled the kitchen because you had saved up for a long time to do so. Or that you were able to buy the couch because you cut back on eating out. Pride will have to go by the wayside to promote a healthy financial environment.

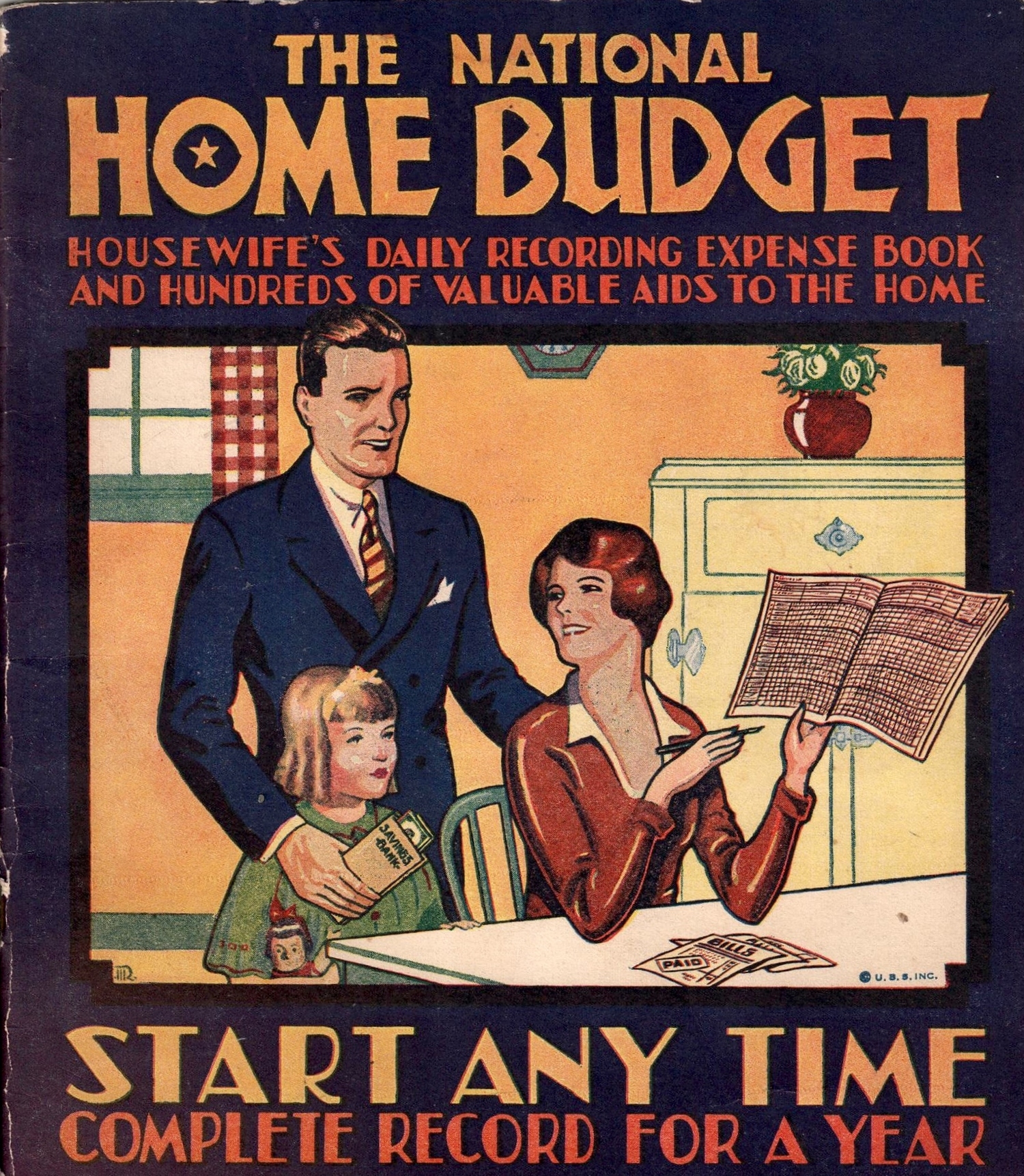

Photo by Steven Martin

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply