Finances are a huge source of stress for many people – but they don’t have to be. Here are a few tips to start you on your path to financial freedom.

1. Make a Plan

When was the last time you got in the car and drove somewhere new without directions or your phone to guide you? Probably never. So why do we do this every day with our finances? From daily impulse purchases to spur-of-the-moment vacations, we constantly spend money without a plan. But why do we avoid planning? Well, it takes time. It’s can also feel like you’re locking yourself into something inflexible. It might also reveal some ugly spending habits that prevent us from achieving our goals. However, the first step is to make your plan and dial in where you want to be in five, 10, 20, or even 40 years. Talk about your personal and financial goals with someone! Sit down with somebody who’s experienced financial ups and downs (maybe a mentor or a financial professional) and work out the steps you need to take to achieve your goals. Perhaps the best part of having a plan is that it isn’t set in stone – you can adjust it when life changes.

2. Make Your Plan Work for Everyone

This is primarily a challenge for you and your spouse to face, because you likely have different perspectives about how money should be handled. If you’ve ever had a conversation about finances with your spouse, you may have thought about saying anything along the lines of “Because that’s right way to handle money – that’s why!” However, there is no right way. There is only a way that works for both of you and your family. Would you rather work together towards a common goal, or drag the other person along the way to a goal that’s not shared? Both strategies are doable, one is easier. Certainly, compromise is difficult in any relationship arena but remember why you’re having the conversation about money in the first place. You are invested in your life together and want to cross the finish line together. That sentiment shouldn’t change when you log into your bank account.

3. Separate and Define your Money

This is probably the most basic tip we have. Make separate homes for your money. What does this mean? It means that you don’t all your funds in one place. Pop quiz: if you had to find an important document from November 13th of 2012 would you rather look through a pile of papers from the last 5 years or in the folder marked “Important Documents November 2012?” Easy choice right? However, many people chose the stack of papers method when it comes to money – that is having all funds in the checking account or savings account. Should the money you’re using to save for a home down payment belong in the same pile of money you’re using to pay the electricity? No. They are categorically not the same. Should your rent payment come from your emergency fund? Of course not. Create division of your funds so you can clearly see how much you have for each goal, whether it’s a travel fund, emergency fund, college savings, or a home remodel fund. Not sure where to find an account outside of you bank? You can always use another bank, or better yet, set up an account with a trading company like TD Ameritrade, E-Trade who hold your money for free and only charges you when you make trades (which are optional), but will hold your funds in a money market account which is as good as cash and earns slightly more interest than your savings account.

4. Get Your Priorities Right

This one is simple. Determine how much money you want to save each month. Determine how much you need to put toward debt each month. Consider those funds gone (or better yet, set up automated payments and savings so they are automatically removed from your checking account), then go ahead and live life with the rest of the money you have.

5. Budget

Before you close your browser window after reading the nasty “b” word, budget, know that budgets come in many forms and can be shaped to fit your needs. For example, if you’re already working on tip four, you’re budgeting. Budgeting can be as simple as using the Mint app on your phone to track spending, or choosing not to outspend your checking account balance each month (after you save and pay debts). It can also be as in-depth as creating a huge purchase-by-purchase spreadsheet that chronicles all dollars coming and going. Or it can be somewhere in the middle and just track spending by category, like how much you spent on food last month. Work to support your current and future lifestyle desires, but track where your funds are going regardless. Again, this budget has to work for every decision-making family member involved. If it doesn’t, it’s worthless.

6. Make an Adventure Fund

You’re probably thinking I just sit at home and build spreadsheets and count pennies on weekends. While that does have some appeal, I doubt I’d get my wife on board with that so, believe it or not, we do go places and see things. I used to worry about affording these activities. I don’t any more. Why, you ask? Because we have an adventure fund. A fund specifically designed for having fun. A fun fund, if you will. We dedicate a certain amount of money each month to the fund and it is either spent or saved with the goal of having fun, traveling, or investing in something we both enjoy. Now, we don’t have to answer the question of whether or not we can afford to plan that trip to Europe, or if we need to skip buying a ski pass this season. We either have enough money in the fund to make the purchase or we need to save more money and plan to do the activity later. This is a great way to combat impulse spending while developing the good financial habit of saving for things you want.

Which piece of budgeting advice do you think will help you most? As always, give us a call or send us an email if you’d like any help putting these six ways to reduce financial stress into action.

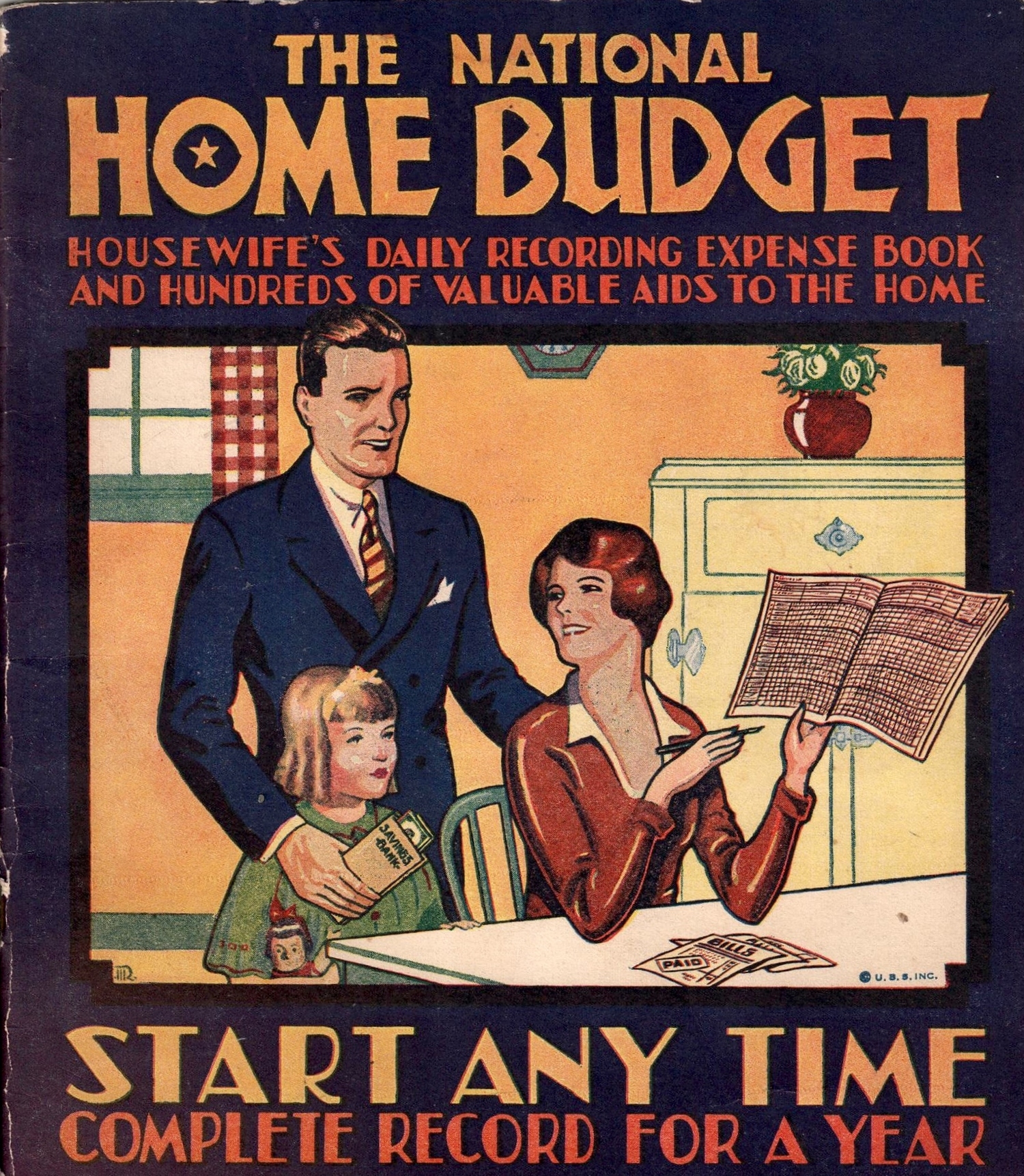

Photo by Mike Hoff

- U.S. Stocks Make New Highs - December 6, 2024

- Rising Rates Create Headwinds - November 8, 2024

- The Fed Finally Cuts Rates - October 10, 2024

Leave a Reply